A new automatic billing system has been introduced to simplify healthcare for EU staff in Luxembourg

EU staff in Luxembourg can look forward to a significant reduction in healthcare paperwork following a new administrative agreement signed last week between the PMO (Office for the Administration and Payment of Individual Entitlements) and the Federation of Luxembourgish Hospitals (FHL).

The first tangible result of this agreement was the introduction of an automatic direct billing system for hospital care on 1 October 2025 in several large hospitals, including the Robert Schuman Hospital (HRS) and the Centre Hospitalier de Luxembourg (CHL). Other hospitals are expected to join the scheme in the coming months.

Relief from Administrative Burden

The measure is part of a high-level, interinstitutional initiative launched in 2020 to enhance the attractiveness of Luxembourg as an institutional seat for the EU.

In practice, JSIS (Joint Sickness Insurance Scheme) affiliates with primary coverage can generate a specific JSIS cover certificate for hospitalisation, childbirth, or major outpatient treatments. By presenting this certificate upon admission, the hospital will send invoices for the relevant services directly to the PMO for payment. Any remaining amount owed by the staff member will be offset against future JSIS reimbursements or deducted from their salary. Initially, the system covers inpatient treatments and specific high-cost outpatient procedures.

Union Action for Attractivenes

The introduction of direct billing addresses a long-standing issue raised by staff representatives. U4U has long advocated for action on the high costs in Luxembourg, noting that high medical invoices add a financial strain on staff already burdened by the country’s notoriously high housing costs.

The push for a more attractive workplace has already seen success with the recently introduced Luxembourg housing allowance, which was a key outcome of the interinstitutional efforts. Staff now hope that the resolution of medical billing issues will further improve the overall appeal of working at the Commission in Luxembourg. However, this simplification of paperwork will not solve the issue of high medical costs, as healthcare prices in Luxembourg remain high; it is merely a crucial first step.

Survey on the Joint Sickness Insurance Scheme (JSIS)

The Joint Sickness Insurance Scheme (JSIS) is the common sickness insurance scheme for staff and officials of the European Union.

In particular, it covers the primary health care needs of several dozen staff, officials and pensioners of the European institutions.

In order to better defend your interests as staff representatives in the various bodies concerned (Staff Committee, Management Committee, social dialogue meetings, etc.), we would be grateful if you could tell us more about your experiences, your satisfaction and any problems you may have with this service.

We therefore invite you to complete the short questionnaire (10-15 minutes) available here.

Readers’ letter: a message to my male colleagues

Dear male colleagues,

As a friend and mother of young men involved in the Movember generation, I feel a particular responsibility towards men’s health. I’ve been particularly touched by friends who, just as they were about to retire, discovered that they had prostate cancer. This article is therefore a plea for better care and increased screening for this cancer.

It is generally accepted that women are more vigilant about their health, regularly incorporating breast and cervical cancer screening into their healthcare routine. Conversely, it seems that men are less inclined to take a proactive approach to their health. Without passing judgement or analysing the causes of this trend in depth, it is essential to recognise an alarming fact: in the United States, prostate cancer is now the second most common cause of cancer-related death in men, and it ranks third in almost all other developed countries, including Luxembourg.

Recent studies, such as the European ERSPC study, show that screening for prostate cancer using the PSA test can significantly improve patient survival when diagnosed at a localised stage – reducing the risk of death by 37% at 14 years. It is therefore clear that the PSA test is not only useful but also safe when interpreted correctly and used without overuse.

I am pleased to note that the Commission’s medical service has included these screening recommendations in the annual health check-up programme. This is an important step forward and I would like to express my gratitude for this effort.

However, screening is only effective if it is carried out. That’s why I encourage you, my male friends and colleagues, to find out more and discuss the issue with your doctor. If you’re in the age group concerned, don’t hesitate to go for your annual check-up, either at the medical service or with your general practitioner (GP). Taking care of your health isn’t just a necessity, it’s an act of responsibility to yourself and your loved ones. Don’t put off screening – anticipation is the key to better health and a longer, more fulfilling life.

Major medical expenses?

Check your eligibility for special reimbursement

We know how much medical expenses can put a strain on your budget, especially when they accumulate over the course of the year. Fortunately, the Joint Sickness Insurance Scheme (JSIS) provides additional support for those of us who face significant medical expenses. This article will guide you through the requirements to qualify for a special refund and how to go about it.

What are the rules? Who is eligible for the special refund?

Have you already been reimbursed for your medical expenses, but do you still have uncovered costs that exceed half your basic monthly salary? These costs, which are often higher than the original 15-20% due to ceilings that have been out of date for almost 20 years, may entitle you to a special reimbursement under Article 72.3 of the Staff Regulations.

Important to know : The “basic salary” is the first line on your payslip (TBA), before any allowances or benefits.

Let’s take a concrete example. A GFIII-9 in Brussels has a basic monthly salary of 3,520.14 euros. Half of this is therefore 1,760.07 euros.

If the amount of medical expenses you have to pay during a rolling year (31 March-31 March, 30 June-30 June) exceeds €1,760.07, you are entitled to a special reimbursement under Article 72.3.

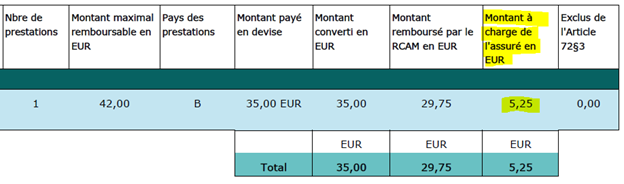

To be more precise, when you look at a statement, you need to look at the amounts in the penultimate column. In our example 5.25 euros.

If the sum of all the amounts shown in the penultimate column (minus the amounts shown in the last column) is more than half your basic salary in a given year, you are entitled to a special reimbursement under Article 72.3.

Let’s imagine that the sum of all these amounts 5.35+8+20 etc. is 2,120 euros. This is much more than 1,760.07 euros. We then have two scenarios.

Case with household allowance: You will receive an additional refund of 359.93 euros (2,120 – 1,760.07).

Case without household allowance: The additional reimbursement will be 90% of the overpayment, i.e. 323.94 euros (350.93 * 90%).

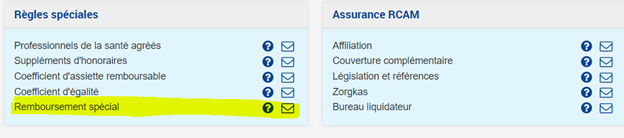

How can you claim your rights?

You think you’re entitled, but you’re not sure? No problem, just contact PMO. With PMO Mobile, send a message to check your eligibility for the special refund.

Note: Claims can be backdated up to three years. This means that major expenses incurred two years ago (operations, dental expenses, etc.) can still be taken into account.

After a few days or weeks, you will receive confirmation of your eligibility. If you are eligible, all you have to do is sign a claim form and you will be reimbursed.

To conclude:

We encourage you to make a claim if you think you are entitled to it. This little-known article of the Staff Regulations provides an important safety net to ensure that the cost of medical care does not become disproportionate to your salary. Given the increase in medical fees and the failure to update the reimbursement thresholds over the last 17 years, even routine expenses (speech therapy, physiotherapy, spectacles and some dental treatment) could make you eligible.

If you have any questions, don’t hesitate to contact us at HR-REP-PERS-U4U-ASSISTANCE-INDIVIDUELLE@ec.europa.eu.

Towards improved medical checks

Staff representatives have recently been made aware of concerns expressed by some of you following your experiences of medical examinations. One point in particular caught our attention: the lack of empathy shown by some medical examiners.

This feedback has highlighted the need to create a more welcoming and supportive environment for those of us who are going through difficult times. It is imperative that every colleague feels respected and supported, especially in such sensitive circumstances as those affecting our health and well-being.

To this end, we have proposed the introduction of a post-test feedback system. This mechanism will allow anyone who has been tested to share their experience anonymously. The aim is twofold: firstly, to assess and, if necessary, improve the quality of the interaction with the examining doctors; and secondly, to ensure that the examination process is conducted with respect and dignity for everyone.

We would also like to remind you that any colleague who wishes to be accompanied during a medical examination may request the presence of a staff representative. This is to give you additional support and to ensure that your rights are fully respected.

In the spirit of constructive social dialogue, U4U has joined with other unions in calling for discussions to be opened on medical screening practices. We firmly believe that the well-being of our colleagues is a priority that deserves our attention and collective action.

The aim of this dialogue is to promote continuous improvement in our working conditions, reflecting our shared commitment to a respectful and caring institution. We remain confident that this exchange will lead to significant progress for all, and strengthen trust and well-being within our community.

Your voice is vital in this process. We encourage you to share your experiences and suggestions via the HR-REP-PERS-U4U-ASSISTANCE-INDIVIDUELLE@ec.europa.eu functional mail box, helping to shape a future where every employee feels listened to, valued and supported.

Together we can make a difference.

Disability and agencies: a silent struggle

In the workplace, disability situations affecting employees or their families often remain in the shadows.

Despite the existence of a single point of contact to centralise disability-related enquiries and information, some colleagues are unaware of its existence. We are still regularly confronted with stories of distressed families struggling to navigate the administrative maze.

A single point of contact has been set up for employees, pensioners and their dependants for all disability issues, help and advice.

Testimonies and realities from the field

Real-life cases such as that of A., the father of a severely disabled child, who waited more than two years for social assistance, or B., who was faced with a substantial bill for speech therapy sessions at school for her autistic son, illustrate the difficulties encountered. The situation is often discouraging, people are unaware of the assistance available and the administrative procedures are full of pitfalls.

Towards greater awareness and accessibility

In particular, the intranet sites of the decentralised agencies do not always communicate clearly on this point. What’s more, disability remains a taboo subject, not to mention the fact that parents often find it difficult to recognise the difficulties their child or relative is facing.

However, disability-related medical expenses may be reimbursed by the Joint Sickness Insurance Scheme (JSIS), sometimes subject to prior approval and/or reimbursement.

In the case of children, the allowance may be doubled if you can prove that your child has a disability (mental, physical, intellectual or sensory impairment).

Finally, financial assistance is generally available for non-medical expenses.

What are we talking about?

Non-medical expenses may relate to the place of residence (specialised institute, sheltered work environment, day centre, etc.), transport and equipment (stair lift, bath, guide dog, car adaptation, adapted pram for a very severely disabled child, etc.), care, schooling and educational needs.

For example, the cost of education in schools that offer special programmes for disabled children can be considered as non-medical expenses.

he possibility of financial assistance exists and has been defined in the Conclusion 281/20. One thing to bear in mind in this case is that Article 1.1 states: “The institutions may grant assistance in accordance with Article 76 of the Staff Regulations. Subject to the availability of appropriations, assistance may be granted to disabled staff members and/or their dependants. The amount of such appropriations shall be determined annually“. It refers to “institutions”. Finally, for financial assistance for anything “non-medical“[1] , If you work for an agency, you should contact your agency’s human resources department.

My second point is the reference to “disability“. According to Article 1d(4) of the Staff Regulations, a person is deemed to have a disability if he or she has “a long-term physical, mental, intellectual or sensory impairment which, in combination with various barriers, may hinder his or her full and effective participation in society on an equal footing with others“. In particular, “to be entitled to assistance, the person concerned must have a disability of at least 20%, as assessed by the institution‘s medical officer[2] “.

As a reminder, the European Schools (Brussels, Luxembourg) have an intensive support programme for children with special needs. Sometimes there are local schools that integrate children with special needs, but this depends on each country/city.

In situations where the European or local schools are not able to integrate these children under the right conditions, it is advisable to contact the single entry point which will guide you through the process.

In conclusion, although structures and tools are in place, their effectiveness is hampered by a lack of awareness and accessibility. A concerted effort on the part of authorities, employees and decision-makers is essential to improve the situation of disabled people and their families in the workplace.

If you have a disability (potential or actual), the key word is: go through the single entry point. Our colleagues will help you.

E-mail: HR HANDICAP DISABILITY

Postal address:

European Commission:

HR.D.2 Assistance to active and retired personnel

PLB3 01/164

1049 Brussels, Belgium

Tel: 02/29 712 33

And if you need anything, don’t hesitate to contact us at HR-REP-PERS-U4U-ASSISTANCE-INDIVIDUELLE@ec.europa.eu.

[1] It is sometimes difficult to know what is potentially covered by the medical service and what is covered by social assistance. Do not hesitate to ask the PMO and the Single Point of Entry if you are in any doubt about this distinction. Example: Speech therapy sessions at school.

[2] IThis raises the question of who is the institution’s medical officer if the person concerned works in an agency, for example.

Tested for you: medical claims via your smartphone

As staff representatives, we sometimes receive requests from colleagues who are late in submitting their claims. Unless there is a valid reason (force majeure) for a delay of more than 18 months, claims are rejected.

Are you the kind of person who keeps certificates in your wallet, bag or envelope and finds submitting claims a chore? Are you the kind of person who tends to forget them and therefore miss out on a refund?

A good way to avoid these inconveniences is to try the PMO Mobile application. We did it for you and we have to admit that it makes life easier.

At the same time as the doctor gives me the certificate, I take a picture of it. Then I use my application to create my claim (the little + on the bottom right) and attach the photo. The next day I get a statement saying that the reimbursement is in process. Simple, fast and efficient.

And that’s not all: I can consult all my claims and accounts at any time and follow their progress. I can access my RCAM insurance certificates, create new ones, request cover, report an accident… I can even ask a question with a single click on the application.

If you connect from your computer, a QR code will allow you to install the application.

Want to try it out? Follow the guide!

How to make PMO Mobile saving your time?

The app does not require downloading and cannot be found in commercial app stores. It is web-based and is easily accessible from all commonly used web-browsers by scanning the QR code or by entering https://webgate.ec.europa.eu/PMOMOBILE .

PMO Mobile is also available in EC on the GO. Once in the app, you can bookmark it or add it to your favourites for faster access.

To secure your private data, PMO Mobile is protected by multifactor authentication. This video shows all the available options to authenticate and how each of them works.

More info:

PMO Mobile user guides EN FR

PMO Mobile FAQ EN FR

Joint Sickness Insurance Scheme: review of reimbursements has started

First amendment to the General Implementing Provisions (GIP): a decision in the pipeline as a first step in the revision of the GIP

After a lengthy negotiation process, the reimbursement GIPs are to be amended. The decision is in the pipeline and should be adopted quickly.

Firstly, this amendment ensures that MAP is better taken into account. U4U has been fighting for this for a long time and it’s a big step forward. Until now, fertility treatments have only been reimbursed in cases of pathology (broadly speaking, cancer). The Medical Council’s decision was based on the theoretical argument that the scheme reimburses health costs and therefore an illness. It should be noted that this is not necessarily the case, as the JSIS also reimburses preventive treatments, vaccines, etc.

We are very happy for all our colleagues who are or will be affected.

This amendment to the GIP also includes an increase in two key ceilings: the ceiling for general practitioners from €35 to €42 (Brussels basis) and the ceiling for family doctors from €50 to €64 (again Brussels basis).

Finally, other ceilings complete this modification.

- Fixed dentures increase from €250 to €350

- Hearing aids from €1,500 to €1,800

- Urinary nappies range from €600 to €1,320.

U4U welcomes these increases, which are certainly not enough, but are a first step in reviewing our GIP.

U4U would like to take this opportunity to remind you of a little tip when submitting a claim for reimbursement from a specialist. Let’s take a concrete example: you go to an optician (or gynaecologist) and he or she carries out some tests (e.g. an eye test or an ultrasound). When you pay, you pay, for example, 100 euros. This €100 covers the fees and the tests carried out, the code of which appears on the INAMI certificate you receive. To ensure that you are correctly reimbursed, you should therefore code your receipt as an analysis and examination and not as a specialist consultation. Using the codes on the certificate, the PMO will then be able to identify the tests carried out and reimburse them accordingly (i.e. above the current ceiling of €50 or the future ceiling of €64).

Healthcare reimbursement

New perspectives for our healthcare reimbursement

It’s about time: For the first time in several years, a proposal to amend the JSIS GIP has been submitted to the social dialogue (formal discussion between the unions and the administration) after being discussed by the CGAM (Health Insurance Management Committee).

Put simply, new, more favourable reimbursements for our medical expenses are in the pipeline.

The proposals on the table are as follows:

- Reimbursement, subject to certain conditions (in particular age and maximum number of attempts), for treatments related to medically assisted procreation

- An increase in the ceiling for GP consultations from €35 to €40

- An increase in the ceiling for specialist consultations from €50 to €60

- An increase in the ceiling for certain types of fixed dental prosthesis (crowns, etc.) from €250 to €350

- An increase in the ceiling for purchase or repair of hearing aids from €1,500 to €1,800

- An increase in the ceiling for incontinence-related supplies from €600 to €1,200

Overall, this progress is to be welcomed, but it comes late (the real cost of medical expenses has been rising for years without any adjustment of the ceilings) and is still insufficient.

This situation is all the more problematic given that, after years of small deficits (due in particular to the reduction in contributions following the amendment of the Staff Regulations in 2004), the European Union’s sickness insurance scheme now has a surplus (described by some as a “financial cushion”) of around 400 million euros, equivalent, for example, to what the Commission hopes to obtain from the planned sale of its buildings in Brussels.

This is a considerable sum when you consider that, at the height of its deficit, the RCAM was losing 10 million euros a year. The so-called “financial cushion” would therefore be enough to cover the deficit for no less than 40 years if it were to return to that level (which is unlikely).

So we’re saying it loud and clear: this money is part of our salaries, transformed into a kind of “forced savings”. It must therefore be used for its intended purpose: to reimburse our healthcare costs.

Let’s not let this money sit idle any longer! And let’s not run the risk that one day it will be diverted to cover some deficit or other! There is an urgent need to reform the JSIS, raising the thresholds for several types of benefit, improving access, particularly to mental health benefits, and taking account of new types of treatment.

As U4U has done in the past (and we would particularly like to acknowledge the work of our former representative on the JSIS Management Committee, Kim Slama, in advancing the issue of medically assisted procreation), we will continue to fight for a health care reimbursement system that better reflects the actual costs incurred by affiliates, as well as changes in the cost of medical care.

Our ideas in these areas are as follows:

- The introduction of a sliding scale for ceilings, which would allow the ceilings for each category of care to be automatically reviewed at regular intervals (e.g. every 5 years) for all reimbursable services. Instead of setting the ceilings at a fixed amount, requiring a formal decision for each change, it would be possible to set the ceiling on a sliding scale, for example at a given proportion of the average prices paid for each reimbursable service.

- The calculation of the above-mentioned mobile ceilings could also be adjusted, under certain conditions, depending on where the care is provided (e.g. if the average price of care is 20% above or below the general average or even the average in Brussels).

- A better level of reimbursement in general for services related to preventive medicine; the reduction of services related to annual visits organised by the Commission service would be an excellent opportunity to increase these reimbursements to 100%.

- Simplification of the prior authorisation system. A certain number of services which are systematically authorised on the basis of objective criteria (e.g. number of services accepted, etc.) could easily be excluded from the prior authorisation system. Such administrative simplification would also be a source of savings.

- Greater transparency of medical board opinions and the external expert opinions on which they are based (immediate publication of these opinions, subject to anonymisation of patients’ personal data).

A general review, based on the opinion of a committee of medical experts made up of equal numbers of doctors appointed by the administration and staff representatives, of the maximum number of psychotherapy services authorised and, more generally, a more comprehensive approach to mental health, in particular by facilitating access to psychotherapy in the longer term.

JSIS – Medically assisted procreation

MAP : reimbursement of procedures for women without a proven pathology – Significant progress on the dossier

JFor several years now, U4U has been requesting a revision of the JSIS GIPs on the reimbursement of medically assisted procreation (MAP) (see below our previous articles).The GIPs for the JSIS, Title II, Chapter 7.3 lay down the rules on medically assisted procreation — MAPs. These rules — designed in 2005 and 2006 and adopted in 2007 — envisage reimbursement of the use of MAPs techniques (in vitro fertilisation (IVF) or artificial insemination (AI)) only where there is a pathology in the couple, from the affiliate or from the “recognised partner” within the meaning of the staff regulation.De facto, claims from lesbian couples, single women or whose partner is not recognised within the meaning of the staff regulation and couples whose sterility has no proven pathological basis, are excluded from reimbursement by the JSIS.Last June, at the request of the Central Office of the JSIS, the Medical Council reiterated the conditions for access to reimbursement, arguing in favour of maintaining the existence of a pathology.For U4U, extending the MAP reimbursement to other groups is not a medical opinion but a societal political decision. Above all, the aim is to establish a right for any contributor to the scheme, which contributes an equal percentage of his/her salary, to receive the same reimbursement for the same act for the same purpose: allow a parental project to a person/couple who, outside a MAP, could not succeed.It is surprising today, when Community policies call for more resources to be mobilised to promote the inclusion of diversity, that our health system does not follow the step of the most progressive Member States in this area (that have legislated in this direction since the early 2000s).Indeed, since 6 July 2007, under the Belgian insurance medical system that, mutatis mutandis, serves as a reference to the architecture of our scheme, the reimbursement of the MAP has been authorised to any woman who applies for it, independently of the existence of a pathology. A dozen Member States have a similar reimbursement practice.No women engage in this MAP path of cheerfulness of heart: it is long, uncertain and difficult in many respects. This means that for all affiliates who wish to be pregnant by assistance but without a proven health problem, JSIS coverage is less favourable for them than if they were covered in their Member State. However, more than half of the members of the JSIS live and work in Belgium. A large number in Luxembourg. Not to mention the other MS where the MAP for these groups is authorised and reimbursed.At its plenary session on 5 November, the Central Staff Committee (CSC) of the Commission asked its constituents at the Health Insurance Management Committee (CGAM) to support a request for a revision of the MAP. Indeed, the CGAM gives an opinion on the many claims lodged by the affiliates whose previous authorisation for undergoing MAP reimbursed by JSIS has been rejected. Above all, it is entitled to propose a modification of the GIPs if need be.At its plenary session on 23 November, the CGAM endorsed the idea of proposing a revision of the GIP to remove the reference to a pathology and to reimburse the MAP to those who request it. The CGAM proposes, but it is the Commission, to which the other institutions have delegated the management of the JSIS – via the Central Office for execution – that decides whether to act on such a proposal.Whereas unitary action by trade unions would also be effective, U4U offered them to support the revision of the MAP and to call for a social dialogue with DG HR on that issue.U4U considers that our JSIS should align itself with the practices already decided in the Member States and in particular, in Belgium, whose health legislation serves as a benchmark for our JSIS since more than 60 % of the affiliates reside there.With this in mind, a rapid revision of Title II, Chapter 7.3 of the GIP could be envisaged, the reference to the existence of a pathology withdrawn and our affiliates be reimbursed for their MAP treatments.

01/12/2020

JSIS – An insurance card for members in the Netherlands

JSIS members residing in the Netherlands will soon benefit from an insurance card giving them better access to health care in that Member State: good news for all colleagues.Our system is little or not known to the national systems of the countries where its affiliates reside. This causes many problems when, for example, being taken care of by a hospital and being billed. For years, members have been asking for an insurance card that would allow them to be recognised, but the nature of our system makes this impossible on a global scale, or in some Member States.However, thanks to the efforts of members of the Management Committee and the PMO, JSIS members residing in the Netherlands will soon have an insurance card allowing them better access to health care in that in that member state.Negotiations have been concluded with the insurance company CZ, which insures many Dutch nationals. By going through this company, colleagues will benefit from the same tariffs offered to nationals, which should lead to a reduction in health costs of about 20% (on average). The big difference is that the patient will not encounter any problems in accessing care and will be charged the lowest price, without discrimination compared to a national affiliate.CZ will strictly apply the GIPs and JSIS affiliates will retain all the benefits and conditions of our scheme. They do not change regime, they transit through a national operator, CZ.The agreement between CZ and JSIS has been finalised and is expected to enter into force soon. For the time being, the new system is in a pilot test phase. As soon as it has been demonstrated to be effective, it can enter into force. It is everyone’s hope that this will be in the fall. The PMO is preparing the necessary communication for affiliates, indicating what the agreement consists of and its practical arrangements.The model agreement with the Netherlands will have consequences for future negotiations with the other Member States. Ways exist to start similar negotiations with a Belgian insurance company. With 50% of our affiliates residing in Belgium, an identical card would make life easier – and reduce costs – for thousands of affiliates.

26/06/2020

Revision of the DGE and medically assisted procreation

Revision of the General Implementing Provisions (GIP) of the Joint Sickness Insurance Scheme (JSIS)

As indicated in a previous article, the Management Committee of the JSIS has set up an ad hoc working group which, in December 2018, began work on revising these GIPs which govern all the regulatory provisions that organise our scheme.

The latest GIPs were adopted in 2007. They are outdated and pose many problems, whether in their day-to-day application to members’ claims, or because the reimbursement ceilings established at the time, for example, no longer correspond to medical tariffs and should be seriously updated. Current GIPs also have difficulty in taking account of developments in medical science, the changing needs of society or the integration of best practice in health cover in the Member States, to name but a few. It is therefore imperative to review and update them.

However, since the end of 2018, the work has been progressing slowly for several reasons, in particular the lack of resources, which the working group needs, and a problem of method. While the Settlement Offices in Brussels, Luxembourg and Ispra have taken stock of the difficulties they have encountered in applying the GIP and have forwarded this information to the Working Group, the resolution of these difficulties alone does not provide a solution to the problems of adapting the reimbursement scales, nor can it constitute a reflection on the necessary changes to the scheme.

This immense work remains to be done. It needs to be organized. Experts should be solicited, a method of consultation with stakeholders should be defined, and above all, human resources (reporting, secretariat, drafting) should be made available to this working group and a timetable should be drawn up so that progress can be made. For not only was this inventory work laborious, not only is the group made up of volunteers who participate in addition to their normal activities, which makes it difficult to organize their availability, but the Coronavirus crisis has gone through it, which has cancelled all the planned meetings. Work is again delayed.

Yet this crisis, which reveals, among other things, the importance of health systems that protect and cover properly, reminds us how fundamental prevention, for example, is and how much more should be invested in it. The areas in which we are beginning to be less well covered than if we were beneficiaries of our national scheme – dental prevention and free dental care for children, for example – are becoming more and more numerous.

If nothing changes, and if we rely solely on the good will of the working group, this revision of the GIPs will still take years (identification of needs, discussions, establishment of proposals, social dialogue, inter-institutional circulation, and adoption).

However, in many areas, this is taking far too long: measures must be taken quickly (see MAP article below). There is an urgent need to find a mechanism to update the ceilings without having to reopen the GIPs for this, which is an energy-intensive and time-consuming process. There is an urgent need to review the conditions for reimbursement of medically assisted procreation. There is an urgent need to rethink preventive medicine and vaccination campaigns. The way in which the expenses of persons with disabilities are met and how the most vulnerable are guaranteed the widest possible coverage of their needs should be studied. The conditions of dentistry need to be reviewed, since teeth in poor condition trigger many cascading diseases, as the current rules governing dentistry fall far short of meeting the need for dental care.

In short, DG HR, which is responsible for coordinating the JSIS on behalf of all the institutions, must provide the JSIS central office with the resources available to the members of the JSIS Management Committee. By doing so, the working group can speed up its work and quickly put forward a proposal for amended GIPs for consideration by its peers and, more broadly, by stakeholders.

If not, DG HR must promote and make possible by appropriate means work on ad hoc revisions to update these GIPs as and when necessary, as it has done in the recent past to update the definition of serious illness.

Working for the European institutions cannot lead us to be less well covered as if we were remaining within our national system. There is an urgent need for a revision policy and for providing the working group with the necessary resources. Above all, it is urgent to do so quickly.

JSIS – Medically-assisted procreation – MAP – why procrastinate ?

U4U has already written its support for an amendment to the GIP of the JSIS relating to MAP. Indeed, the current GIP makes the reimbursement of certain MAP procedures conditional on the existence of infertility linked to a pathology. However, there are some impossibilities to procreate by natural means that do not originate from a proven pathology, including within heterosexual couples. In some cases, factors that cannot be detected by analysis may be the cause of difficulties in procreation. Women, like men, are not machines, and stress or anxiety-provoking situations can cause a non-pathological “infertile” environment. However, for JSIS affiliates in this case, reimbursement of the MAP is not accepted. More and more of them are lodging a complaint with the Appointing Authority, which is being rejected because of the state of the legislation in force. It is true that a revision of the GIP is under way, but for a number of reasons it is taking time. U4U is of the opinion that the conditions for reimbursement of the MAP should be reviewed in the context of an ad hoc express revision of the GIP, and not in the context of the global revision, which will not be completed before several years.

Our rules are out of date in relation to the changing needs and sensitivities of the population covered by our system and in relation to best practice in the national health systems of the Member States. DG HR must show the same speed with which it wished to review the issue of serious diseases and propose an amendment to be adopted as soon as possible. There is not one person who uses MAP for gambling. It is a necessity. Our affiliates are all contributors to the JSIS and they should be guaranteed equal rights to reimbursement in the event of infertility or impossibility (whatever its origin), under the same conditions of number of trials per child as for colleagues who were discovered a pathology.

4/05/2020

Request for an appointment with the DHR: Extension of the right to reimbursement by the JSIS of medically assisted procreation to lesbian couples, infertile couples with no proven pathology and women without a recognised partner (November 2020)

COVID-19: Request from CCP and Unions

Note for the attention of Commissioner Hahn Johannes

Re: The Joint Sickness Insurance Scheme and COVID-19 – time to act.

While providing a rather generous coverage, the Joint Sickness Insurance Scheme (JSIS) also foresees high payments for its affiliates: 15% to 20% of the health care cost, limited further by specific ceilings.

The only mitigation is contained in Article 72(3) of the Staff Regulations: the affiliates payments over a 12 month period cannot exceed a half month basic salary. In case of serious illness all costs are covered 100% of the costs, up to 150% of any specific ceiling. The only problem: serious illness has to be recognized individually by the settlements office thorough the medical council and the criteria are rather strict.

Whether COVID-19 (Corona virus) falls under the definition of serious illness is not clear and can dependents on the particular situation of the person affiliated to the JSIS. It is quite likely that Corona virus is not recognized as a serious illness in all cases, leaving the affiliate to face substantial payments.

JSIS has a high reserve, that could easily absorb the extra costs in case the criteria for serious illness are applied in a liberal way when it comes to Corona.

General Implementation Provisions for JSIS are negotiated under the framework agreements between the Unions and the Commission followed by an opinion of the Central Staff Committee.

The Unions and the Central Staff Committee are asking that under the framework agreement, the Commission decides that Covid-19 is recognized as serious illness and that therefore all costs related to Corona as testing, first line medical care, hospital transfers, hospital care and revalidation benefit from full reimbursement.

We furthermore insist to apply the rules in an un-bureaucratic way, allowing all those who have incurred medical costs related to Corona to declare these costs as serious illness without having to go through individual assessments by the Medical council. We would like also that a clear decision and information on that subject is sent to the affiliates of RCAM.

Signed by Alliance – G 04 – USF – U4U – FFPE – Central Staff Committee

18/03/2020

Commission: Annual medical visit: what will change soon

Article 59.6 of the Staff Regulations: “Officials shall undergo a medical check-up every year either by the institution’s medical officer or by a medical practitioner chosen by them.“For years, the Commission has no longer been reminding staff of the obligation to carry out this visit. Only 6% of colleagues use the mandatory annual visit to the Commission’s Medical Service [SM]. And 24% who wish to do it make use of their doctor, providing protocols and forms ad hoc. Without a doubt, among the 70% who do not undergo the annual visit in a manner known by the institution, a number still proceed to an annual check-up, without declaring it to the employer, and are reimbursed by the Sickness Fund.A large part of the staff does not know that he is obliged to this annual visit, obligatory. And for staff who know their obligations, waiting longer and longer to get an appointment with the medical service are discouraging.The Commission no longer remembers the obligation to submit to this visit because it no longer has the necessary means to carry it out.It should be noted that for the three sites in Brussels, Ispra and Luxembourg, the Commission employs 13 doctors (full-time equivalent). It is little for nearly 33,000 agents. The doctors dedicate themselves to medical examinations of new recruits, the follow-up of invalidity cases, the absences for sickness, the return to work, the annual visits, etc.Given the number of hirings linked to the limitation of the duration of the contracts which leads to perpetually recruiting, and consequently to the number of hiring examinations that this generates, the medical service can no longer cope with the volume of the annual medical visits, in particular. Not to mention that it is also the responsibility of the administration to do prevention of so-called occupational diseases and psychosocial risks at work, and for that, the resources – human and financial, for that matter – are lacking.Since the Staff Regulations provide for the possibility of going through one’s doctor to carry out the annual visit, DG HR decided that the medical examination would soon be carried out only by the own colleagues’ doctors, in order to free the medical service from this task and to affect the doctors to other tasks, having the same degree of importance.Colleagues may consult the doctor of their choice to carry out the annual visit. They will have to download the forms and ask for the reimbursement of the costs incurred (for the visit and the exams foreseen in the protocol of the annual visit) in the system JSIS online, but under the rubric “medical examination” to be reimbursed at 100%, by the employer. Indeed, the annual visit is an obligation for the employer: it is up to him to finance it.DG HR still has to deal with some technical details, in particular that of carrying out laboratory examinations. They are currently performed at the SM, regardless of the formula chosen (medical service or own doctor). If tomorrow everyone can freely choose where to carry out his medical check-up, it will not be practical at all for colleagues to split their visits between the office / infrastructure of the doctor of their choice, the lab of the SM and the various other laboratories for more complex complementary examinations. This will add a difficulty for colleagues, for whom life as a member of JSIS is not easy in the absence of a recognized social insurance card and with the membership of a social security system not well known in Europe, not to mention elsewhere.While waiting for these announced changes, U4U recommends that colleagues carry out the mandatory annual visit. It’s a matter of prevention: the sooner a disease is detected, the better it is treated, the greater the chances of recovery. And U4U also invites staff to carry out their medical check at the expense of the employer, and not at the expense of JSIS. The Commission must know the actual cost of its obligation to enforce Art.59.6, if only to forecast its cost in the relevant budget line.DG HR should start a campaign soon to remind colleagues of the obligation to submit to an annual visit and inform them of the new practical arrangements for the annual medical check-up, simplified for the staff, hopefully.However, many colleagues are reluctant to submit to the mandatory annual visit: they fear that sensitive data such as medical information will be used against them in the course of their careers.DG HR also has to face the challenge of trust. It must give clear information about the procedures in place, ensure the tightness of services between them and recreate the benevolent environment necessary to restore confidence. And most importantly, it must provide staff with what the Staff Regulations require: it must fight with Member States to get the financial means to properly ensure the duty of employer foresight.We do not compromise with health. A staff in poor health is what costs the more for organizations, and states.

August 2019

MAP: the proposal of U4U

In 2019, U4U gave a number of conferences to the EC, the EP and the EEAS, in some regulatory agencies, to explain the ongoing revision of the GIPs that govern JSIS medical reimbursements. And on several topics, U4U explained its proposals for regulatory change.As part of this review, U4U proposed, among other things, to review the rules on reimbursement of treatments for the medically assisted reproduction (MAR). Indeed, the decision to reimburse the treatment of in vitro fertilization (IVF) or artificial insemination (AI) only in the case of a pathology identified in the couple does not originate either in the statute or in the JSIS’ common rules. It is a decision of the medical advisor, based on the argument that the plan only reimburses health expenses, therefore originating in an illness. It should be noted that JSIS does not only reimburse expenses related to illness, but also prevention programs, childbirth, vaccinations – regardless of the existence of a health problem – and even funeral expenses, etc. This argument therefore seems rather fragile. For U4U, the argument of the medical service no longer fits with the evolutions of our society.”Sterility” among homosexual couples or single women is not linked to a disease: it results from an impossibility to procreate.The requirement to prove a pathology is also an intrusive procedure: no woman resort to IVF or artificial insemination out of gaiety of heart.The question of reimbursement terms can also be discussed, but the principle of giving up the need to demonstrate a pathology would be a big step forward. Especially since the granting of prior authorization and the processing of the required documents are time-consuming for the services concerned, not to mention for the affiliate.U4U is therefore of the opinion that the reimbursement of MAR treatment should be authorized to all those who request it, under the conditions fixed elsewhere (eg age limit, number of attempts, ceilings, etc.).The European Union is at the forefront of diversity inclusion policies. Many Member States have followed suit if they have not anticipated it. It is therefore paradoxical that our system does not integrate the Union’s progress on individual freedoms and equal rights.Moreover, many of our institutions seem already ready to support an evolution of the GIPs in the sense of refunding the MAR to the affiliates who would make the request, irrespective of whether their “infertility” results from an impossibility or a pathology, regardless of any investigation into the legitimacy of such a request other than the desire for a child. It would therefore be a real breakthrough for our affiliates, and if it evolves as desired, a welcome simplification of the procedure that U4U supports.

August 2019

Joint Sickness Insurance Scheme: improved benefits in sight

News on better inclusion of disability in the GIP; preventive medicine: patience, the new programmes are coming; news on the recognition of severe asthma, and on the reimbursement of certain drugs!

U4U at the heart of RCAM news to better defend the cover we all have: here is the latest news

April 2019

Important documents on JSIS

- JSIS: review of the 2007 GIP (April 2018)

- Prevention of psychosocial risks (February 2018)

- Stress, burnout and cardiology (Video)

- Impact of psychosocial risk-related illnesses on JSIS expenditure (January 2018)

- JSIS preventive medicine (February 2018)

- Malfunctioning of the JSIS: unpaid invoices and erroneous accounting! (Jan 2018)

- The CGAM in good health! (about the 2015 report)

- Joint Sickness Insurance Scheme: Management of the Reserves – Update/State-of-Play, November 2016

- JSIS: where do we stand? Analysis of the 2015 management report

- Scheme results for 2016.

- JSIS: our mutual fund

- Luxembourg: overpricing of healthcare

- Letter from Mrs Gaffey, Director of the PMO, on the overpricing of healthcare in Luxembourg

Joint Sickness Insurance Scheme: what should we do?

Persistent rumours have been circulating for some time about our sickness insurance system. There are claims that it is in deficit and that something has to be done urgently.However, the reality is quite different: the 2012 deficit is approximately 9 million Euros, while we have a reserve of around 270 million Euros. This means we have enough money for at least 25 years, even if the deficit continues, which remains to be seen. There is no need for any panic measures.However, at the behest of some staff representatives, a dangerous letter was sent to various department heads (our system is common to all institutions) proposing an urgent increase in the monthly contributions we pay from our salary, and that the PMO should be instructed to stop paying for certain services. Other ideas were proposed, such as (again) additional insurance at our expense.Our sickness insurance scheme is funded by our contributions, in other words, our indirect salaries: 1.7% from the employees (1/3) and 3.4% from the employer (2/3). This system has been subject to an operational deficit for some years.U4U believes that the current situation is not of immediate concern and that our present system must be retained, and indeed improved. In fact, with a substantial reserve (270 million Euros) and regular increases in contributions – due to progression through the grades, promotions and the results of the future method from 2015 – our system has firm foundations.A modest deficit compared to the reserve, caused by temporary problemsThe main reasons for this modest deficit are as follows:a) The 2004 reform, by lowering starting salaries, deprived the scheme of some of its expected revenue for a time; the 2013 reform struck it a further blow by slowing down and halting careers.b) Freezing index-linked salaries contributes to the fund’s deficit by keeping salaries, and therefore contributions, at a lower level.c) The retired population is experiencing a demographic peak, so it is natural that this sector is consuming more in terms of healthcare than the working population.d) It should also be stressed that the widespread practice of over-invoicing (+15% in Luxembourg, a little less in Brussels) increases the operating deficit.This operating deficit is also limited by the financial revenue of the Sickness Insurance Scheme’s reserve.Faced with this situation, it seems incomprehensible that some managers are inclined to act quickly:a) by increasing revenue through raising contributions. This method is inappropriate at the moment, because an increase, even a slight one, would be difficult to bear in the current context of budget cuts;b) by reducing expenditure through introducing measures intended to lower the reimbursement for some medical services. High-expense sectors under the microscope include: long illnesses, hospitalisation, etc., i.e. those sectors most important to staff faced with a serious illness.Balancing the booksThese measures are unnecessary as, even in the short term, we can see that the situation is likely to improve and that the books will be balanced:a) The new method of adjusting salaries. When we see the positive effect of the slight increase of 0.8% for 2012, reducing the predicted deficit for 2013 to slightly below 3 million Euros, it is reasonable to assume that this deficit will be substantially reduced by the salary increases in the coming years.b) The careers of staff hired in the lowest grades since 2004 are in the course of developing and the process of promotions and steps means they are now reaching better paid grades, which will boost revenue.c) The retirement of the ‘baby boomers’ of recent years is in the process of natural correction; the age pyramid will resume a more normal shape over time.d) Extending the retirement age (as deplorable as it is) will also have the effect of increasing contributions to the sickness fund from the full salaries of staff nearing the end of their careers.There is therefore no need for urgency. The sickness insurance scheme has a total reserve of approximately 270 million Euros, which will last the system for many years (at least 25). In any case, this reserve allows us to take the time to see if the positive changes referred to will have a real impact on restoring the financial situation.The initiative taken by some staff and retiree representatives in writing a dangerous letter is totally unjustified. Paying higher contributions, reducing the services covered by the PMO or moving some reimbursements to an additional insurance paid for by us as a supplement are not avenues to be explored lightly.A considered proposalU4U therefore proposes the following approach:a) Not to take any hasty measures at the moment, while making sensible savings where possible, particularly by establishing agreements, taking measures to prevent over-invoicing, etc.b) Specifying the mandate for the group of experts responsible for setting up simulations to take account of the developments referred to above and other external factors (e.g. level of expenditure on health).c) Continuing to provide the same quality service as at present.

15/04/2014

Table of changes in the deficit since 2003

JSIS: Operating balance in Millions of Euros

| Average | Average 2004-07 | Average 2008-12 |

| 1 Operating balance | +1.3 | -14.6 |

| 2 Net financial revenue | +7.3 | +10.7 |

| 3 Net financial balance | +8.6 | -3.9 |

| 4 Net reserve fund | 203.8 | 197.5 |

The net financial balance (3) is the sum of the operating balance (1) and revenue from interest (2)

The reserve fund (4), which is 270 million Euros in 2012 (193.7 plus the working capital) can therefore fund a net financial deficit of €10M for 25 years.

An increase in our contributions of 0.1% (with the employer’s share: 0.3%) increases the revenue of the Sickness Fund by 6%. The maximum increase (0.3%, total 0.9%) allowed by the Staff Regulations without consulting Member States would increase the Fund’s revenue by 18%. Both increases could therefore largely offset the deficits if they continue.

Documentation

Letters from AIACE to Ms Souka (DG HR) and Mr Lemaître (PMO Director) and annexes : AIACE working paper

October 2014 Health Insurance Conference: Health insurance or cost-cutting exercise?

Response from K. Georgieva on the PMO: operating problems raised by the PAC

CGAM : les chiffres

Health insurance : Joint scheme: 2003-2012 data

| Year | 2003 | 2004 | 2005 | 2006 | 2007 | 2008 | 2009 | 2010 | 2011 | 2012 |

| Number of affiliates | 43.822,00 | 45.513,00 | 51.403,00 | 56.818,00 | 60.851,00 | 63.886,00 | 66.842,00 | 70.919,00 | 72.460,00 | 74.549,00 |

| Of which active | 31.936,00 | 32.579,00 | 37.641,00 | 42.545,00 | 45.887,00 | 48.339,00 | 50.638,00 | 54.077,00 | 55.208,00 | 56.504,00 |

| Of which post-active | 11.886,00 | 12.934,00 | 13.762,00 | 14.273,00 | 14.964,00 | 15.547,00 | 16.204,00 | 16.842,00 | 17.252,00 | 18.045,00 |

| Number of beneficiaries | 90.762,00 | 93.822,00 | 103.758,00 | 113.024,00 | 119.851,00 | 125.901,00 | 131.710,00 | 139.475,00 | 143.440,00 | 148.443,00 |

| Of which active | 72.232,00 | 73.641,00 | 82.322,00 | 90.962,00 | 96.964,00 | 102.247,00 | 107.175,00 | 113.996,00 | 117.383,00 | 121.319,00 |

| Of which post-active | 18.530,00 | 20.181,00 | 21.436,00 | 22.062,00 | 22.887,00 | 23.654,00 | 24.535,00 | 25.479,00 | 26.057,00 | 27.124,00 |

| Revenues | ||||||||||

| Total contributions (€m) | 141,70 | 151,90 | 167,30 | 183,40 | 196,60 | 211,10 | 226,30 | 244,50 | 256,20 | 262,40 |

| Of which active | 109,80 | 116,70 | 127,30 | 141,10 | 151,80 | 163,10 | 174,80 | 189,20 | 197,50 | 201,80 |

| Of which post-active | 31,90 | 35,20 | 40,00 | 42,30 | 44,80 | 48,00 | 51,50 | 55,30 | 58,70 | 60,60 |

| Operating revenue (€M) | 138,10 | 152,10 | 167,60 | 184,40 | 196,80 | 211,70 | 227,00 | 245,20 | 256,70 | 262,80 |

| Net financial income (€M) | 7,50 | 8,80 | 7,70 | 6,60 | 6,30 | 10,40 | 9,70 | 15,80 | 9,60 | 7,90 |

| Total revenue (€M) | 142,40 | 161,00 | 175,60 | 193,90 | 207,50 | 223,20 | 237,70 | 261,80 | 266,30 | 270,80 |

| Expenses | ||||||||||

| Operating expenses (€M) | 138,10 | 141,10 | 170,50 | 179,00 | 205,10 | 235,90 | 242,70 | 251,10 | 266,60 | 279,90 |

| Dépenses totales (M€) | 139,30 | 141,20 | 170,90 | 181,80 | 209,40 | 237,00 | 243,80 | 251,80 | 266,60 | 280,00 |

| Of which active | 76,00 | 74,70 | 88,50 | 96,80 | 112,50 | 131,80 | 136,60 | 141,50 | 148,20 | 152,10 |

| Of which post-active | 63,30 | 66,50 | 82,40 | 85,00 | 96,90 | 105,20 | 107,20 | 110,30 | 118,40 | 127,90 |

| Operating profit | ||||||||||

| Net profit for the year (M€) | 3,10 | 19,80 | 4,70 | 12,10 | -1,90 | -13,80 | -6,10 | 10,00 | -0,30 | -9,20 |

| Operating income (M€) | 0,00 | 11,00 | -2,90 | 5,40 | -8,30 | -24,20 | -15,70 | -5,90 | -9,90 | -17,10 |

| Reserve fund | ||||||||||

| Total assets (M€) | 211,50 | 233,90 | 247,50 | 269,20 | 278,10 | 276,40 | 285,10 | 273,90 | 281,60 | 281,30 |

| Net assets [M€) excluding commitments | 174,80 | 194,60 | 199,40 | 211,40 | 209,60 | 195,80 | 199,70 | 201,50 | 196,80 | 193,70 |

CGAM: the situation of the health insurance fund

SELECTED EXTRACTS FROM THE 2012 ANNUAL REPORT, WHICH ANALYSES DATA FOR THE 2011 FINANCIAL YEAR

SOURCE: TYPE “ANNUAL REPORT” IN THE SEARCH FIELD.

Changes in the population covered by the scheme: In 2011, the population of members and beneficiaries continued the growth recorded in previous years. The total number of members rose from 70,919 in mid-2010 to 72,460 in mid-2011, an increase of 2.2%. The total number of beneficiaries under the scheme at the same dates rose from 139,475 to 143,440, an increase of 2.8%. The ratio of beneficiaries to members is approximately 2:1, and has remained stable over time.

The scheme’s operating income rose from €245.2 million in 2010 to €256.7 million in 2011. This 4.7% increase is largely due to the increase in the number of contributing members (+4.5% between mid-2010 and mid-2011) and the increase in the average contribution. The population of contract staff and parliamentary assistants is growing fastest, while the number of people retiring is increasing more slowly. Despite these favourable demographics, the low level of starting salaries and, consequently, of contributions, is unable to offset the increase in care costs for the oldest members and beneficiaries.

Changes in supplementary cover: Under the terms of the scheme, because they are the spouse or child of a JSIS member, these beneficiaries receive additional reimbursements from the JSIS in addition to their basic cover (i.e. cover other than the JSIS). In 2011, this population fell by 3.7% compared with 2010 (25,268 beneficiaries in 2011 compared with 26,232 in 2010), following an 18% increase in 2010 compared with 2009.

The above-mentioned decline is partly reflected in the amounts reimbursed, which fell from €5.6 million in 2010 to €5.5 million in 2011, a slight decrease of 1.8%. As in 2010, in 2011 the JSIS reimbursed an average of 47% of the actual costs in question, in addition to the amounts reimbursed by the national and private social security systems. The JSIS ceilings are much more favourable than the latter, resulting in a JSIS contribution of up to 82% (dependency benefits – stay in paramedical establishments) or 68% (childbirth expenses) since the primary systems apply strict ceilings (see Annex 8.4 of the AR, “Financial analysis by the Central Office on the financial situation of the JSIS at 31 December 2011”, point 10, pp. 15 to 17).

Contribution trends: Since 2007, we have seen a steady increase in the average member contribution. The average contribution for 2011 was €3,536 (up 2.6% on 2010). This increase is due, on the one hand, to the result of the method for adjusting salaries and pensions (even though the 2011 adjustment was frozen at the end of 2011) and, on the other hand, to the impact of promotions and step advances. Revenues, and therefore the balance of the scheme, are very sensitive to these two factors.

According to calculations by the Central Office, for 2011, the absence of any adjustment to pay and pensions resulted in a shortfall in contributions of around €2.2 million.

- The average contribution per active member in 2011 is at the same level as in 2004 (before the impact on contributions of the reform of the Staff Regulations),

- There is convergence between the average contributions of active members and the average contributions of non-active members, with the latter enjoying stable growth in income subject to contributions.

Expenditure trends: operating expenditure, i.e. reimbursements of medical expenses, amounted to €266.6 million in 2011. This represents an increase of 6.2% compared with 2010, which is greater than the increase in the number of members (+4.5%) or in contributions (+4.7%).

After a ‘peak’ in average expenditure per member or beneficiary in 2008, the first year after the new GIP came into force, 2010 was the second year in a row in which average expenditure fell, even in nominal terms. After two years of decline, average expenditure per member and per beneficiary is now rising again. In 2011, compared with 2010, average expenditure per member rose by 3.6% and per beneficiary by 3.0%.

The benefit category that generates the most reimbursements is hospitalisation. Its relative share of total expenditure rose by a further 2.3 points between 2010 and 2011 (the highest increase of any category), and now stands at 29.2%. Given that this phenomenon has been observed for several years, the consequences for the scheme’s equilibrium should be drawn fairly quickly. The relative share of the other two categories with significant expenditure, namely Radiology-Analysis (15.1%, – 0.5 points compared with 2010) and Medicines (12.6%, – 0.6 points compared with 2010), is decreasing in this breakdown.

Preventive medicine consultations carried out in 2011 and paid for in the same year accounted for expenditure totalling €4.7 million (2010: €4.3 million, +9%). In the same period, 8,589 examinations (+9%) were authorised, confirming the growing popularity of this service, which is available to all beneficiaries (including children) – see appendix 8.9. However, the average cost per consultation remained fairly stable at €546 in 2011 compared with €543 in 2010 (+0.6%). This specific part of the scheme’s expenditure will certainly need to be closely monitored in the coming years due to the growing success of this option offered to scheme beneficiaries.

Of all the expenses incurred by beneficiaries in 2011, 79.9% were reimbursed by the scheme (and, where applicable, the beneficiary’s primary insurance fund). This represents a decrease of 0.3 points in one year (see appendix 8.6). When we look only at “normal” reimbursements, without 100% reimbursements for serious illness, this average reimbursement rate is constantly decreasing, with 80.1% in 2008, 80.0% in 2009, 77.6% in 2010 and 77.5% in 2011.

The scheme’s benefit ceilings and packages have not changed since 2007, despite the fact that healthcare costs are marked by continuous inflation, even if this is not uniform. The statutory objective of covering 80 to 85% of staff medical expenses, which was brought up to standard by the DGEs in 2007, is therefore once again being called into question.

Comparison of expenditure and revenue: With the exception of 2006, the period 2005-2011 was characterised by a surplus of operating expenditure over operating revenue. Since 2008, this surplus has fallen to €5.8m. In 2011, operating expenses exceeded operating revenue by €9.9 million.

From the 61-65 age bracket onwards, average income stagnates while average expenditure increases rapidly. These figures highlight the sensitivity of the scheme to changes in the age pyramid (see chapter 3.1). This must be taken into account in all future analyses as part of maintaining the scheme’s equilibrium.

The JSIS is a solidarity scheme, based on the assumption that younger people, who are expected to consume fewer medical services, pay contributions for older people, who consume more. The overall level of contributions must remain sufficient from the earliest grades to cover expenditure. It should be noted that the average member contribution is €3,536, compared with the average expenditure per member of €3,679. Assuming that the level of expenditure is comparable for each category of active employee and each age bracket, the impact on the scheme’s financial equilibrium of the affiliation of contract staff, due to their low average remuneration and, consequently, their low contributions, is therefore decisive. This impact is amplified for a period by the recruitment, since 2004, of civil servants and temporary staff at a lower grade and with a lower salary.

The scheme’s financial situation is becoming increasingly precarious and needs to be closely monitored. These developments are mainly due to :

- the €2.2 million shortfall in contributions due to the failure to adjust pay and pensions on 1 July 2011;

- inflation in healthcare prices;

- the very high prices charged by some of the hospitals used by members and beneficiaries;

- increased use of preventive medicine;

- the absence of levers for action such as the national funds, which can impose tariffs, set up health pathways, reduce administrative costs by electronic means, and encourage doctors to charge agreed prices;

- Insufficient awareness on the part of members of the need to behave thriftily.

In order to re-establish the main balances and, above all, to guarantee the long-term future of the Scheme, the Management Committee makes the recommendations set out in point 7 of the report entitled “Conclusions and recommendations”.

Note 1: The findings and trends observed over the last 10 years raise the question of the scheme’s economic sustainability. However, the information provided and to be provided must be handled with objectivity. It is not possible to establish a “major” trend, but rather a combination of factors. The deficits of the last two years, for example, could have resulted in a zero revenue/expenditure balance (at least much less than the deficit observed) if the salary adjustment had been applied.

It is a given that staff numbers will be cut by 5% (the highest salaries!) and that an influx of pensioners is expected within the next 2 years (less revenue, more healthcare). Limiting the number of CAs (less favourable salaries) is not on the agenda. Furthermore, the Council wants to freeze indexation for 2 years (which has already plunged us into the red). If these freezes are implemented without catching up, given the above and the steady increase in healthcare costs, the deficit will be structural.

Note 2: With the exception of 2006, the period 2005-2011 was characterised by a recurring negative operating result. Although this had been falling since 2008, reaching €5.8 million in 2010, the operating loss reached €9.9 million in 2011. While contributions increased by 4.8%, from €244.5 million in 2010 to €256.1 million in 2011, expenses rose by 5.9%.

In 2011, in contrast to 2010, net financial income of €9.6 million (2010: €15.8 million) did not cover the negative operating balance. Over the same period, the situation on the financial markets was much less favourable than in 2010, although financial income was still quite satisfactory.

The favourable trends seen in 2010 seem to be reversing in 2011. The net result for the year went from a surplus of €10.0 million in 2010 to a loss of €0.3 million in 2011. This phenomenon was exacerbated by the Council’s refusal to adjust pay and pensions on 1 July 2011, resulting in a shortfall in contributions of around €2.2 million.

PMO agreements in Spain

Nearly 1,300 colleagues and pensioners living in four Spanish autonomous communities are affected by the agreements signed between the PMO and public health services.

U4U has long been calling for the PMO to sign agreements with the health services of the Member States in order to better control health costs. The higher the costs, the greater the proportion to be borne by the member. And our population is a prime target for healthcare inflation. In Spain, the PMO has succeeded in concluding four agreements with health centres, enabling members to benefit from public prices. It is continuing its efforts to convince other autonomous regions to sign up with it.

The 4 autonomous regions of Spain with which the PMO has signed an agreement:

- Galicia: SERGAS signed on 01.02.2012

- Madrid: SERMAS signed on 12.07.2013

- Andalusia: SAS signed on 07.11.2014 (launch in 2015)

- Catalonia: CATSALUT signed on 23.01.2015

These agreements give colleagues access to health services in the autonomous region at the same rates as nationals. On the one hand, the option for affiliates to use the JSIS is maintained, but the possibility of using the health services of the Autonomous Region is added.

This applies to statutory staff or retirees under the JSIS/RCAM scheme and to beneficiaries under primary cover whose place of work or residence is in these autonomous regions.

These agreements are only valid in the Autonomous Region in which the health card was issued. Public health services outside the autonomous regions are not included.

All active or retired statutory staff living in these autonomous regions who wish to join this agreement must complete and sign the form sent by the PMO with their letter of application. The form with the beneficiaries’ details must be duly completed if they wish to be included.

The PMO pays benefits directly to the health service, including primary care consultations, with the exception of Andalusia. Benefits received in the primary care centre will be paid for by the users. Affiliates must request reimbursement from the JSIS as is customary.

Invoices for hospital care based on the original invoices in the member’s name (the member will also receive a copy of the invoice) will be paid by the PMO.

Practical aspects of the invalidity procedure

The legal framework for invalidity is set out in the Staff Regulations: Articles 9, 52, 53, 59(4), 77 to 84, 7 to 9 of Annex II and 13 to 16 of Annex VIII.

First of all, we need to define the two conditions for recognition of invalidity:

- be under 66 years of age;

- be in a situation where the employee is acquiring pension rights, which excludes the CCP, for example.

In order to be entitled to an invalidity pension, the staff member must be recognised by the Invalidity Committee as suffering from a permanent invalidity which makes it impossible for him/her to perform his/her duties within the service.

The Invalidity Committee, which issues opinions, is made up of a doctor appointed by the staff member, a doctor appointed by the institution and a third doctor appointed by mutual agreement between the first two. The matter is referred to the Invalidity Committee either by the Appointing Authority, in the case of accumulated leave in excess of 12 months over three years, or by the staff member concerned without any time limit. The Invalidity Committee must establish the invalidity (or lack thereof); determine the cause of the invalidity, if any; and indicate the need for and frequency of follow-up examinations. The work of this body is secret and its conclusions are given to the staff member and his or her administration. The Appointing Authority decides on the invalidity of the staff member on the basis of the prior opinion of the Invalidity Committee (art. 53 of the Staff Regulations).

There are currently discussions on the scope of the opinion of this committee, which in all cases can only make strictly medical assessments (Vicenti v EUIPO, T-747/16 of 23 April 2018). The Community court’s review applies to the constitution and operation of the Invalidity Committee and to the reasons given for the opinions it issues. However, the court does not review the medical content of these opinions, provided that they have been duly adopted (O/Commission, T-376-02 of 23 November 2004 and Vicenti / EUIPO, op. cit.).