Report on the balance of the pension scheme

New report on the actuarial balance of the pension scheme: is everything in the best of all possible worlds?

In a report published on April 14, the Commission examined the actuarial balance of the European civil service pension scheme. In the 2013 reform of the Staff Regulations, a review clause was introduced requiring two evaluations, one in 2018 and the other in 2022, based on Article 14 of Annex XII of the Staff Regulations. The aim of this report for the Commission is also to present a favourable report to the Council by highlighting the savings generated by the reforms of 2004 and 2013 and thus avoid a new reform of the Staff Regulations.

The report begins by reviewing the fundamentals of the pension scheme for civil servants. It reminds us that it is not a pay-as-you-go scheme, but a notional fund that is closer to a funded scheme, even though it “also has certain characteristics of a solidarity scheme”. This fund is evaluated regularly to ensure that it is in balance. This balance takes into account the retirement age, which is evaluated every five years. To do this, the Commission takes into account the aging of the population. At its last assessment in 2021, the Commission did not consider that life expectancy had increased significantly enough to raise the retirement age beyond 66. It also welcomed the fact that “its” retirement age is among the highest of the member states’ civil service retirement ages, which is also a way of defending the current age in the Council and preventing its increase. Unfortunately, this rather advanced retirement age also has a perverse effect, since if one wishes to leave before the mandatory age, penalties are applied. However, article 42 ter, which allows for derogation from this rule, is in practice very rarely applied, which pushes staff to remain in their posts, even though some of them may be exhausted or no longer able to do their work properly for health reasons. The evaluation of the balance is also done with the help of other parameters, on the one hand there are demographic hypotheses with mortality tables, invalidity tables, the theoretical age of retirement or the probability of being married at the date of retirement, and on the other hand financial hypotheses, in particular real interest rates observed for the long-term public debt of the Member States as well as the increase in salaries linked to the professional advancement of the members of the Union’s personnel.

The Commission then analyzes the developments in the pension system, placing greater emphasis on the benefits of previous reforms. For example, several measures directly affecting staff have been taken to reduce the share of the EU budget allocated to pension payments. For example, there is the Interinstitutional Agreement of 2 December 2013, which provided for a 5% reduction in the number of staff in the EU institutions and agencies between 2013 and 2017. So we have seen a decrease in the number of officials in the institutions during this period. At the same time, new funds were made available to recruit contract agents. Finally, between 2014 and 2021, the Commission’s staff decreased slightly while the overall population of the institutions increased from 58,000 to 66,000 officials and agents. This increase is mainly due to the recruitment of staff for the agencies and newly created bodies such as the European Prosecutor’s Office.

Finally, the Commission welcomes the significant savings achieved by the 2004 and 2013 reforms, the first of which alone is expected to save €1 billion per year in the long term. However, the Commission acknowledges, albeit half-heartedly, that these reforms have had a negative effect on the attractiveness of the FPE.

A few figures to conclude: since 2014, pensions have generated 5.8 billion euros of revenue for the EU budget. The expenditure on pensions, on the other hand, increases by about 6% per year, which is also related to the fact that pensioners receive the method and to the increase number of retired colleagues.

Transfer of pension rights from a national pension scheme to the EU scheme

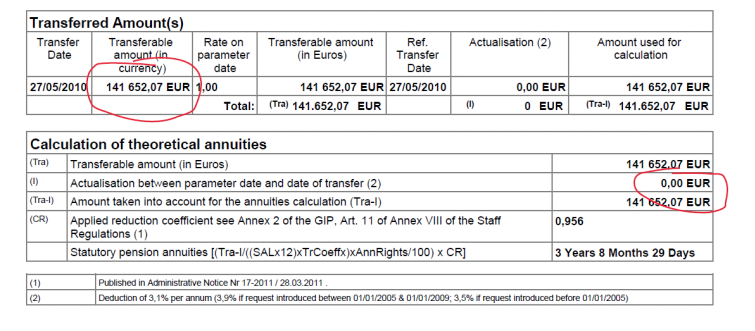

Important judgment of the ECJ on the transfer of pension rights from a national pension scheme to the EU scheme (C-132/18 P)We are happy to inform you that in the case of one of our adherents, the European Court of Justice confirmed the judgement of first instance (case T-728/16) on the deduction of interest from the amount transferred from the national pension scheme to the EU scheme (C 132-18 P).When calculating the pensionable years, the PMO will no longer be allowed to systematically deduct an annual interest rate of 3,1% on a capital sum transferred to the EU scheme, for the period between the date of the transfer request and the date of the actual transfer. The PMO will only be allowed to do so if the national pension scheme was unable to set out the ‘capital appreciation’ during the transfer procedure. That is to say, if the national pension scheme informs the PMO about the exact value of the pension rights at the date of your initial request of transfer, this will be the amount on which the PMO has to base the calculation of pensionable years. We have knowledge that the PMO applied this method since the judgement in first instance on 5 December 2017, however, it might be worthwhile to verify the final calculation of your statutory pension annuities.See the example below: the national pension scheme notified an amount of 141 652.07 EUR at the date of transfer request (to be found on the letter of your national pension scheme; here 27/05/2010). Therefore, this is the amount to be taken into account, and no ‘actualisation’ may be deducted (0,00 EUR).

Please be aware that interest accumulated after the date of your transfer request will go into the EU scheme as ‘capital appreciation’ without any conversion into pensionable years. In many cases, like in the case of our adherent, this amount will be far below the 3.1 % formerly deducted by the PMO.The current administrative practice of the national pension schemes differs a lot between the Member States. Some provide the EU services with all the necessary information including the interests acquired after the date of the transfer request, others do not set out this ‘capital appreciation’ and thus the colleague’s pension rights are subject to a deduction of lump sum of 3.1 % per year of the amount transferred). U4U will ask the Commission to call on Member States for a common approach in the way they reply to the request for transfer of pension rights from the national system to the EU system so that no member of EU staff faces negative consequences.In addition, U4U will urge the Commission to apply this judgment also to earlier cases.

20/05/2019

Transfer IN des droits à pension : la Cour confirme l’arrêt TUERCK qui, pour un transfert de droits à pension acquis dans un régime de pension national vers le régime de pension de l’Union européenne, détermine si la Commission peut ou non déduire des intérêts calculés forfaitairement (15 mai 2019).

Lettre à Mme Souka, DG HR, concernant le transfert IN des droits à pension (octobre 2019)

See also : Transfer of pension rights (transfer IN) (Dec 2020)

The Report on Pensions confirms the sustainability of the scheme

Interim report about keeping in balance the Pension Scheme for EU Officials in the period 2014-2018

Commission interim report on pensions: everything all right?

The interim report of the European Commission on the implementation of Annex XII to the Staff Regulations on the pension scheme for EU Staff aims to ensure that the parameters of the pension scheme guarantee the regime (Article 14, Annex XII and Article 83 of the Staff Regulations).The first part of the report recalls the principles of the regime. We can note the Commission’s reminder about the nature of our pension plan which is not a system based on repartition but on capitalization, funded by a notional accounting fund and social contributions:

“As the EU Staff Pension Scheme is designed as a notional fund, staff contributions are used to finance the future pensions of those who pay the contributions“The Commission’s report states that the actuarial balance of the pension scheme was assured between 2014 and 2018, by adjusting the contribution deducted from the remuneration of each staff member. The method in Annex XII ensures that the contribution to the pension scheme paid into the budget by staff covers one third of the funding of this scheme, as indicated in Article 1 (1) of Annex XII to the Staff Regulations.Only employees’ contributions are deducted and transferred to the EU budget without any specific allocation. The employer’s contributions are not collected, in exchange for the promise of the payment of annual pensions by the Community budget. The report finds that the fiscal cost of pensions will continue to increase until 2040. From this date, it will decline.The considerable savings in pensions that will result from the 2013 reform were confirmed in 2016 by a Eurostat study on the long-term budgetary implications of the cost of pensions. Member States have confirmed that this assessment is realistic and that the latest revision of the Staff Regulations will save 30% of the cost of pensions compared to the cost without reform; not to mention the significant budgetary savings also achieved thanks to the revision of the 2004 Staff Regulations.In addition, the paper recalls the two major statutory changes of 2004 and 2014 with regard to the pension system and the adoption of transitional measures that apply to a large part of the existing staff. In this context, further amendments to the existing rules at this stage would further undermine the security and predictability of the working conditions and benefits provided for in the pension scheme. It is also likely that this would hamper the capacity of the institutions to cope with the significant geographical imbalances observed, particularly in the latest Commission report on this issue.With regard to the budgetary impact of the scheme, the report notes that it has been taken into account in its proposal for a Council Regulation laying down the next multiannual financial framework. The Community executive has thus presented the expected expenditure for the period 2021-2027, based in particular on the annual growth of expenditure on the payment of pensions.These conclusions seem to go in the right direction and allow the regime to continue until 2023, the date of the mid-term review of the financial framework.05/04/2019

Video : Taxing our pensions? A very bad idea!

Taxing pensions? A new attack on staff

Génération 2004 calls for taxing pensions: this trade union organization renews the irresponsible remarks made during the election campaign in Brussels and attacks our former colleagues and our future interests!After asking, during the election campaign in Brussels, to attack our pensions, Generation 2004 by the pen of its current president, asks that the “solidarity” levy be applied to the current retirees and also to all those who will retire in the future.It should be remembered that contrary to the remarks made by uninformed figures in Germany, civil servants pay a substantial income tax. Moreover, for decades, average and above-average wage incomes have been paying a special “solidarity” levy throughout their active careers. Pension contributions are deducted from the total salary of colleagues after all taxes, including “solidarity levy”.Requesting the reintroduction of the additional levy for retirees amounts to charging twice the same tax, once during the working life and a second time during retirement. In fact, what Génération 2004 proposes is an overall decrease in all pensions. All staff will be affected by this measure, including today’s when he is retired. To oppose the actives to the retirees is to introduce a detrimental and absurd division, without counting the danger of reopening the Statute. Contrary to what Generation 2004 suggests, this additional draw on retirees would not benefit active staff, Member States would simply pocket it.We knew that the external enemies of the European civil service wanted to come back to the charge, after 2004 and 2014, to continue the demolition of the civil service and in particular the pension system. We see today that they have allies inside the institutions. An official report from the Commission acknowledges that the last two reforms have greatly reduced the attractiveness of our European civil service.The new fact is the existence of a professional association within our institutions, which works against the interests of public service employees. What do the staff think about it, who were mislead by their comments whereas, since its creation, this organization has no positive results to present? U4U reminds that our pension system in the EU is balanced, that the pension rights acquired by the staff of the European Institutions are a deferred salary that is due to the staff. This pension system is one of the attractiveness elements of the European civil service.The rights acquired by the staff must not be questioned either for the people who have ended their career, for the persons in activity, or for the persons who will join our public service. Their existence is an asset for all present and future staff.

11/04/2018

Letters to the editor

In its Newsletter #35 of May 2019, Generation 2004 proposes to tax high pensions to finance a “public capital-based pension fund”. This pension fund should receive the capital intended to finance the acquired pension rights of contract staff at the end of their contract (6 years) or civil servants who do not wish to finish their career in the Institutions.

Generation 2004 proposes a solution to a problem that does not exist.

The annual contributions are used to finance the pension rights acquired during the year. In the event of early retirement, the capital accumulated during the years of service (contributions) is transferred to an external pension fund chosen by the beneficiary. The terms and conditions of the transfer are set out in the Staff Regulations of Officials of the European Communities, and a specific budget item has been set aside to receive the payment appropriations required for the transfer. The liquidation of benefits is therefore not a problem, and the proposal to tax “privileged pensioners” is irrelevant.

Should these funds be transferred to a public or private pension fund? The question can be asked, but is secondary.

Marc Oostens

Former Commission Accountant 19 June 2019

Facts and arguments: Preserving the pension scheme for EU staff is a priority for staff!

The pension scheme for European Union staff is one of the main achievements of the European Civil Service Staff Regulations. The principle and, for the most part, the arrangements have been preserved throughout the history of the Staff Regulations, despite the partial challenges posed by the last two reforms of the Staff Regulations in 2004 and 2014.

Our pension scheme combines the best aspects of the various national civil service schemes. When you retire, you receive 70% of your final salary, and this amount is increased annually by the Method (which passes on to pensions the increase in the purchasing power of civil servants in the Member States as well as inflation). It is not subject to the exceptional tax known as the crisis tax, and it is coupled with social protection that remains of very high quality. All these reasons explain why staff and their representatives have always fought to preserve it.

Is the scheme in danger?

A relatively new development, however, is that our scheme is no longer being jeopardised solely from the outside. For several years now, and again recently (in April 2018), the Génération 2004 trade union has been calling it into question! So what is really going on?

Contrary to what this union claims, our pension system is sound. Despite the setbacks observed during the last two reforms of 2004 and 2014, this system offers fair pensions for all, the amount and adaptation of which are guaranteed by the new Method for Discounting Remuneration and Pensions. The Method, let us repeat, is not simply indexation to price trends. It ensures that the purchasing power of EU staff, including pensioners, develops in parallel with that of public services in the Member States. For pensioners, in a ‘normal’ economic situation, it means that the amount of their pension increases by more than the increase in prices.

Staff therefore have no interest in seeing this issue reopened, nor any valid reason for doing so. This idea, which is dangerous for everyone and based on a completely erroneous analysis of the pension system, must be vigorously opposed.

Principles that benefit everyone: the importance of the principles of acquired rights and legitimate expectations of the staff of the institutions

The Court of Justice has enshrined the principles of legitimate expectations and acquired rights. These fundamental principles make it possible to guarantee the rights of existing staff against brutal and unilateral revision by Member States, which are increasingly negative and want to call them into question. It is on this basis that, for example, colleagues recruited after 2004 but before 2014 have been protected from the increase in the retirement age to 66 (a retirement age of 63 has been retained for them) and from the reduction in the annual pension accrual rate from 1.9% to 1.8%, applicable to staff recruited from 1 January 2014, following the recent reform of the Staff Regulations.

These two principles protect staff recruited after each reform, as maintaining most of the acquired situations for existing staff limits the possibility of creating excessive differences with new staff. They also legitimise the implementation of corrective measures to attenuate existing disparities, which end up posing management difficulties for the institution itself. These two principles will still protect existing staff in the event that the Member States come back to try to reduce statutory rights once again, in the context of a new reform. This is why they must be jealously protected.

A perfectly sound pension scheme

An erroneous and over-hasty analysis could lead to the conclusion that the pension rights accumulated by colleagues from the EU-15 would be unduly financed by the new Member States, which would pay for the pensions of civil servants recruited before the 2004 enlargement. It should be remembered that our EU staff pension scheme is an actuarial scheme which, by definition, is in balance.

It is financed by indirect salary (employee and employer contributions to a notional, i.e. virtual, pension fund). These contributions can be adjusted each year to cover the discounted value of pension rights acquired during that year. This ensures the actuarial balance of the scheme. The second parameter that balances the scheme is the retirement age.

Each member of staff finances his or her own retirement through his or her own contributions and the contributions that the employer pays on his or her behalf during his or her working life; since this is a pension fund and not a pay-as-you-go scheme. Social contributions are therefore accumulated in the notional fund1.

It is a balanced and very coherent pension scheme, much better than most national systems!

1 Pensions paid by the Community budget reduce the notional fund, while contributions from working people, which correspond to the current value of acquired pension rights, increase the notional fund. The long-term interest rate used in the actuarial calculation is that of the public debt. To avoid cyclical fluctuations in interest rates, a 12-year moving average was used. With the 2014 statute, the moving average is gradually being extended to 30 years, which mitigates the negative effect of the current low rates.

A collective guarantee that would only come into play in extreme cases

The joint and several guarantee of the Member States (article 83 of the Staff Regulations) provides additional security in the unlikely event of the disappearance of the EU or the bankruptcy of the budget. This guarantees the pension scheme, protecting officials in the event of the institutions being dissolved, as happened to pre-war League of Nations pensioners, who continued to receive their pensions even after the League’s demise.

This obligation applies to all new EU Member States, but only in these extreme cases. Under normal circumstances, pensions are financed by the Community budget (heading 5), with pension contributions accounted for in a notional pension fund.

The draft treaty between the EU and the UK states that the UK will continue to pay its share of the pensions of civil servants and retired staff after 1 January 2021, by virtue of this guarantee.

Accumulated pensions as deferred salary

In reality, the EU budget pays pensions on the basis of the theoretical deductions made from the total salary (employer’s contributions and social security contributions) during the working life of staff who have now retired. These deductions are accumulated in a notional virtual fund, to which the long-term interest rate of the average public debt interest rate is applied. The amount of the pensions is matched by this notional fund, which is by its very nature in equilibrium and therefore neither shows a surplus nor a loss.

New colleagues begin to finance their future pensions from their salaries. Retirees receive pensions, as already described, based on the sums they have accumulated throughout their careers.

The virtual pension scheme initially generates cash flow, since the Community budget does not finance a real pension fund. The budget pays the pensions due each year. Since 1962, the Community budget has benefited from substantial budgetary savings, amounting to several tens of billions of euros that were not budgeted for, whereas the annual cost of pensions has gradually risen to just over 1.5 billion euros.

Consequently, it is inaccurate to say that some States (the new ones) pay for the pensions of the nationals of others (the old ones). What’s more, staff pensions are paid out of the Community budget: it is almost impossible to calculate ‘fair expenditure’ on the basis of the nationality of working people and pensioners! Indeed, we would then have to reason in terms of net-contributing Member States and not in terms of new or old Member States (bearing in mind that the “pensions” item represents a tiny proportion of the budget). Attempting this argument is very dangerous, because it amounts to attacking the principle of the statutory and budgetary guarantee of pensions, which has existed since the entry into force of the EEC and Euratom Statutes on 1/1/1962. This would be a political mistake that could backfire on all the staff of the institutions.

A fair system

The statement that the contribution rate is not proportional to the benefits of the scheme and does not take account of retirement age and the level of the accumulation rate is false. Also false is the conclusion that this rate should be higher for colleagues recruited before 2004. This proposal demonstrates a serious misunderstanding of the pension scheme.

In fact, the Staff Regulations define the calculation of the rate of contribution to the pension scheme, which applies to each member of staff, as the ratio between the cost of service in year “n” and the total annual basic remuneration for that same year. It is then adjusted annually, to maintain actuarial balance, on the basis of the following variables:

Demographic trends: Article 9(1) of Annex XII requires the Commission to carry out an annual survey of the age of active and retired employees, which makes it possible to determine the structure of the population, as well as the average retirement age and the invalidity table;

Interest rates: Article 10 of Annex XII provides for the use of the average of the average rates observed for the long-term public debt of the Member States during the last twelve years preceding the year in question. Under the new Staff Regulations, this moving average will gradually cover 30 years. In this way, the Community pension scheme is virtually invested, like a genuine pension fund, in the public debt securities issued by the Member States.

The annual variation in the salary scale for European Union officials (Article 11 of Annex XII to the Staff Regulations) is taken into account in the actuarial calculation, to smooth out cyclical fluctuations. Here too, we are gradually moving from using a 12-year moving average (old Staff Regulations) to a 30-year moving average (new Staff Regulations).

Demagogically comparing the current average pension with the salary of a contract employee makes no sense, since retired civil servants have acquired rights throughout their working life. It should be noted that with the living wage mechanism, in 10 years a contract colleague obtains pension rights equivalent to 40% of the salary of an AST1/1, i.e. a pension of more than 1,000 euros. But aligning pensions acquired over an entire career with the salaries of unfortunately precarious staff would amount to a generalised regression, which would moreover apply most brutally to staff who have only recently entered service.

Avoiding double taxation

Should pensions be overtaxed by the special 6% contribution on salaries? Extending this contribution would mean making pensioners pay twice, since they have already paid it on their working salary throughout their career (the pension is a deferred salary).

Contributions to the pension scheme have been calculated for a pension with no additional deductions. If we were to opt for a system in which the exceptional “crisis” levy applied to pensions, the contribution during working life would have to be lower: current pensioners would have to be reimbursed for the overpayment of the employee contribution paid during their working life.

Should we return to a ‘real’ pension fund?

In its proposal for the 2021-2027 financial framework, the Commission proposes to study the feasibility of a real pension fund, an approach it cautiously ruled out in a 2012 report on the pension system.

If the proposal to replace the current scheme with a system of contributions to a pension fund invested on the financial markets were to be followed, the Community budget would have to pay :

the capital of the notional fund acquired, the amount of which would have to be placed on the financial markets (several tens of billions of euros), which the Member States have no intention of paying;

the indirect salary (employee and employer contributions), from the annual budget to the actual pension fund.

The budgetary authority would have no interest in carrying out this operation. Any formula mixing the current system with a real fund would cost the budget more, as demonstrated in the report adopted by the Commission in 2012.

Staff would have to fear the vagaries of the financial markets. This is a very real fear, as many pension funds of the same type have seen their capital melt away in recent decades as a result of financial crises and investment errors.

In practical terms, our current pension scheme has (initially) saved the budget cash. The notional fund does accumulate a debt for future pensions, but the actuarial calculation of the contribution ensures a balance between the two effects. It should be noted that, as a result of new recruitment, the proportion of pensioners in the total population for which the Community budget is responsible (active staff plus pensioners) has fallen, from 27.1% in 2003 to 25.1% in 2013.

The deterioration in the outlook for pay and career prospects, and therefore the foreseeable reduction in pensions paid following the 2004 and 2014 revisions of the Staff Regulations, has already resulted in a fall in the contributions made by working staff to the pension scheme (from 11.6% to 9.8% for so-called employee contributions, and from 23.2% to 19.6% for so-called employer contributions).

June 2018

EU Review: Financing the EU staff pension scheme

Pensions: towards a funded scheme?

At a meeting on 10 July, Commissioner Oettinger confirmed that he wanted to open up the Staff Regulations to reform the pension scheme. This is a serious attack on our pension rights. It is absolutely necessary to mobilise staff now to avoid a revision of the Staff Regulations, which would be catastrophic for everyone. (July 2018)

Letter from U4U to Commissioner Oettinger (May 2018) calling for social dialogue on this issue.

The Commission’s note presenting its budget proposal for the MFF contains a footnote that falls out of the blue sky, without any information and even less consultation having been held with the social partners:

Page 21 : In the framework of the mid-term review of the Multiannual Financial Framework in 2023, the Commission will reflect on the feasibility of the creation of a capital-based pension fund for EU staff.

This is an idea that has already been examined without success. This just goes to show that the Commission has no memory! Placing our pension fund on the financial markets raises two serious problems:

- Are the Member States prepared to pay the existing notional fund debt in one fell swoop into a real fund, placed on the financial markets at ever-fluctuating and currently very low interest rates? Given the enormity of the sums involved, this is doubtful. In the case of Brexit, the 27 have just agreed with the United Kingdom on the principle of continuing to pay the annual amounts when they fall due.

- Are the Member States prepared to pay the existing notional fund debt in one fell swoop into a real fund, placed on the financial markets at ever-fluctuating and currently very low interest rates? Given the enormity of the sums involved, this is doubtful. In the case of Brexit, the 27 have just agreed with the United Kingdom on the principle of continuing to pay the annual amounts as they fall due.

Even if the Member States were prepared to pay out the capital all at once, this capital would, in future, be subject to the considerable vagaries of the financial markets.

Two aspects of our statutory pension scheme should be borne in mind:

- The moving average (over almost 30 years) for interest rates on public debt stabilises our pension scheme in an exemplary manner. (in application of the Staff Regulations). This is entirely appropriate for a scheme that spans 60 years or more!

- The promise to pay pensions when they fall due, contained in article 83 of the Staff Regulations, is legally much more secure than the underlying promise to pay the financial market securities contained in a pension fund placed on the markets. The current difficulties of such funds clearly illustrate this point*.

Of course, such a development would undoubtedly be accompanied by a new reform (lengthening of the contribution period and reduction of entitlements) which would primarily affect active staff who still have many years to serve and, of course, new entrants.

Many people are not familiar with financial mathematics and have a poor understanding of our pension scheme. But that’s no reason to keep tinkering with it! What’s more, a few years ago, these issues were already examined in a report by the Statistical Office, which led to the matter being buried. Shame to bring up a bad idea again!

07/05/2018

- Extract from the RCAM management report, to fuel the debate on the danger of converting our pension scheme into a fund… like the RCAM!

“In order to mitigate the difficult market environment (and in particular the negative yields) described above, the 2017 investment strategy was implemented throughout the year as follows: […]

In 2017, rates remained at very low levels. High quality securities continued to offer negative yields for maturities up to 5 years and even beyond during certain periods of the year. In order to avoid investing in negative-yielding securities (which if kept until maturity translate into losses), preference was given to investments in sovereign periphery and senior unsecured corporate bonds. High quality assets (core sovereign government bonds, sub-sovereign, agencies and other public issuers) were pushed to longer maturities to avoid buying at negative yields. Overall, as Annex 2.1 shows, positions with the longest durations were taken in 2017 in the safest assets in terms of credit risk rating, and conversely.”

Reader’s comment

I fully share your point of view; it is dangerous to open a discussion on the creation of a pension fund. There is a simple solution to this problem: return to accounting orthodoxy.

Before 2005, the EU recorded on its balance sheet the pension fund held in the Member States’ treasuries. Unfortunately, since then, this Member State debt has disappeared from the balance sheet, despite the opinion of the Commission’s Committee of Experts and repeated requests from the European Parliament.

Yet Article 83 of the Staff Regulations states that the payment of pensions is a charge on the budget and the Member States guarantee the payment of benefits. As the Member States have collected the amount of the contributions (employer’s and employee’s), the payment of pensions is simply a reimbursement of the amounts collected in the past.

During the Brexit negotiations, the UK recognised this debt and guarantees the payment of acquired rights, this outside the annual Budget.

09/05/2018

Reflection on the feasibility of creating a pension fund (May 2018)

Pensions: How much did the 2014 reform of the Staff Regulations cost us?

During a meeting with VP Georgieva on 4 May 2016, a trade union that was already notable for its attacks on our pensions, asked what the Commission intended to do about “the explosion in the costs of the pension scheme”. The Commissioner replied that the Commission had no intention of reviewing the Staff Regulations to change the system and that the peak expenditure should be absorbed by savings in other budgetary lines in section 5.EUROSTAT conducted a study on the foreseeable changes in the pension scheme over the next 50 years, at the request of the Council.The EUROSTAT paper sets out the characteristics of the pension fund: it is a notional fund, the pension rights are acquired by the contributors, the fund does not behave like an asset allocation fund in which revenue and expenditure must be balanced every year.

The employee and employer contribution rate is calculated so that the annual contribution covers the actuarial cost of the pension acquired. By definition, the pension fund is balanced. The employer share is not paid, but is guaranteed by the Member States, and therefore the pensions paid are covered by the annual budget. The 2013-14 reform made it possible to reduce the impact of the pensions paid by the pension fund. The report identifies four sources of savings:

- Pensionable age was raised, thus reducing statistically the number of years in which pensions are paid, in accordance with changes in life expectancy and increasing contributions by extending working life.

- The rate of accumulation was adjusted to 1.8% for entrants since 2014, 1.9% for post-2004 entrants and 2% for those entering before 2004.

- The four-year salary freeze and the creation of an underpaid category – the AST/SC grade – will have a permanent impact by reducing the assessment base for pensions. This lack of earnings will never be recovered;

- The reform of the careers of AST and AD grades, by reducing access to the higher grades, will have the effect of statistically reducing end-of-career salaries.

Other factors can influence the behaviour of the pension fund, such as the increase in the average recruitment age, which could mean that very few employees are able to retire with a full pension.EUROSTAT warns that potential retirement scenarios profoundly influence the results. These scenarios are, all things being equal: no change in the population structure (after a 5% reduction in the number of posts), no change in interest rates, mortality rates, promotion rates (zero inflation), etc. These scenarios are highly unlikely, but make it possible to calculate the savings achieved by the reform, by isolating its effects in the calculations.

The results of the study

The number of beneficiaries of pensions will rise from 20,700 in 2014 to 49,700 in 2064.

Expenditure (pensions paid out): €1,400 M in 2014; €1,339 M in 2064, but with a peak in 2043-44 to €1,956 M (for approximately 44,000 beneficiaries, which represents an increase in expense of 40% for an increase in beneficiaries of 113%). This evolution of the expenditure in 2064 is counter-intuitive when looking at more than double the number of beneficiaries, but is explained by the savings made.

The 2013-14 reform will result in cost savings of 33.6% in 2064, which is €450 M in 2064 and in total over the 50-year period €12,768 M in pensions alone (not including savings on salaries).The EUROSTAT study confirms that the pension fund is not at risk financially and is perfectly sustainable in spite of the attempts to have us believe that it is out of control. Staff members remember that a pension is simply a deferred salary, in other words an acquired right, which confirms the case law of the Court. Any attempt to interfere with it must be opposed.However, this change to the system has been costly for staff. The impact of the 2014 reform will be felt in careers and in working conditions throughout the period under review. Another reason not to tolerate any interference.

Pension Scheme of European Officials (PSEO) – 2017 : facts and figures :

- Defined Benefit Obligation (DBO) at 31.12.2016

- Actuarial assumptions used in the 2017 assessment

- Report on the 2017 actuarial assessment

- Central government pension schemes in the EU : Survey results

Is the EU pension scheme in danger?

Indiscriminate or deliberate torpedoing? Stop the attacks on the European civil service and its staff

“Tu quoque, fili mi!

While public attacks on the European civil service are relentless, we are now witnessing an attack on our pension system, this time from a Commission trade union (Generation 2004).

Here are some of their erroneous assertions:

1) our pension system is a sinking Titanic: this is false; on the contrary, it is solid. On the contrary, it is solid. It enables all staff to retire on the best possible terms and conditions and on an equitable basis. The amount of this benefit and its increase are guaranteed.

2) Some states (the new ones) would pay for the pensions of the nationals of others (the old ones): this is not true. Those who pay the most into the Community budget, from which pensions are paid (around 1% of the budget), are the so-called “net contributor” countries.

Some of their ‘technical’ proposals

3) A higher contribution rate for colleagues recruited before 2004: this proposal to increase rates would only be legally possible and would only have a real financial impact if it applied to new colleagues.

4) Abolition of pension credits: this would penalise colleagues who do not have, or will not have, a full career.

5) Pensioners would also have to pay the special contribution: this would mean reimbursing them for the overpayment of the contributions they paid throughout their working life.

6) Proposal to raise the pensionable age of civil servants who benefit from “better conditions”: this measure could only be applied to recent recruits.

7) Proposal to replace the notional fund with a real pension fund: Member States would have to contribute 50 billion to the budget, and this pension fund would be subject to the vagaries of the markets.

8) Proposal to use the financial income from a real pension fund for the benefit of colleagues who wish to leave the institutions would be tantamount to giving a departure bonus by using everyone’s contributions for the benefit of those who leave the institution.

| Summary of these proposals by status (retired/working) and date of entry into the European civil service |

| Impact of the Generation 2004 proposals, if they were taken into consideration | Current pensioners | Pre – 2004 | 2004 – 2014 | Post – 2014 | |

| Possible improvement | Risk of slight deterioration | Risk of serious deterioration | Risk of very serious deterioration |

Key figures for pensions :

Expenditure entered in the 2015 Community budget (Rec 2. Rounded): €161,800.00 million

- of which administrative expenditure (heading 5): €8,660.00 million (5.35% of the total budget)

- of which pensions: €1,560.00 million

Letter from SEPS-SFPE to Mrs K. Georgieva

Letter received on the notional pension fund:

I congratulate you on this excellent document. However, I would like to clarify the expression “notional pension fund”. I read in your document about our pension scheme: “It is financed – virtually – by indirect salary (employee and employer contributions), paid into the EU budget, which feeds into a notional, i.e. accounting, pension fund”.

The notional accounting pension fund disappeared from the European Union’s accounts in 2005 (€33 billion).

Until 2004, the Commission’s Accounting Officer entered the “acquired rights” of officials in terms of pensions on the liabilities side of the balance sheet and the “notional pension fund” on the assets side, which was represented by a debt of the Member States (the contributions which were not paid into a real pension fund but which were recovered by the Member States in the annual budget balance).

In 2005, this “notional fund” disappeared from the EU accounts (balance sheet asset) and is therefore no longer “accounting”. It should be remembered that the Commission’s accounting rules provided for the inclusion of this notional fund in the EU accounts and that its removal was the subject of an observation by the Court of Auditors and numerous reminders from the EP.

To sum up, I agree with your observations about the qualities of our pension scheme. However, the solidarity guarantee of the Member States is the only security for the payment of our pensions, since the “notional fund” has disappeared from the EU’s accounts. Wanting to re-establish this “notional accounting fund” is no more realistic than creating a real pension fund.

Implementation of Article 42c by the European Commission

The European Commission implemented Article 42c for the first time, inserted into the Staff Regulations by the revision of the statutory text on 22 October 2013, which came into force on 1 January 2014.

In 2014, the Commission abolished the early retirement scheme, which concerned around forty colleagues each year. This scheme was voluntary and the Commission launched an annual call for applications. It made a selection between the various colleagues wishing to leave, taking into account various parameters (gender, DG of origin, category, etc.).

Article 42c does not replace the permanent early retirement scheme introduced into the Staff Regulations in 2004 and abolished in 2014. This is leave in the interests of the service, decided by the Appointing Authority, for colleagues with at least ten years’ service, up to a maximum of five years before their statutory pension age, for organisational needs linked to the acquisition of new skills within the institutions.

The annual number of officials placed on leave in the interests of the service may not exceed 5% of the number of officials who retired in the previous year in the institution.

Once the official reaches pensionable age, the leave in the interests of the service ends and the official is automatically retired (art. 42 c) par.5). Consequently, it is not possible for a colleague affected by this measure to go beyond his or her pensionable age in this position.

Leave in the interests of the service is not a disciplinary measure (art. 51 of the Staff Regulations), nor does it constitute early retirement.

The allowance received by a colleague on leave in the interests of the service, as provided for in Article 42c(7) of the Staff Regulations, is calculated in accordance with Annex IV:

- Pendant trois mois, à une indemnité mensuelle égale à son traitement de base;

- Pendant une période déterminée, en fonction de son âge et de la durée de ses services, sur la base du tableau figurant au paragraphe 3 ci-dessous, à une indemnité mensuelle égale :

- à 85 % de son traitement de base du 4e au 6e mois,

- à 70 % de son traitement de base au cours des cinq années suivantes.

An official placed on leave in the interests of the service continues to receive family allowances (household allowance, dependent child allowance, education allowance). It should be noted that the non-lump-sum part of the household allowance is calculated on the official’s basic salary prior to being placed on leave in the interests of the service. However, the beneficiaries of this measure do not receive an expatriation allowance and no weighting is applied to the allowance resulting from their being placed on leave in the interests of the service. They are no longer eligible for advancement to a higher step or promotion.

Civil servants in this position continue to be covered by the JSIS, as long as they continue to contribute to the scheme (0.7% of the allowance for leave in the interests of the service, for the “employee” contribution).

They may continue to contribute to the pension scheme and accumulate rights until they reach statutory retirement age. The contribution, payable monthly, is calculated on the basis of the allowance for leave in the interests of the service (9.8%).

This allowance is subject to Community tax, deducted at source. However, beneficiaries of this measure are not subject to the solidarity contribution (art. 66 bis), as are pensioners.

Beneficiaries of this measure are entitled to travel expenses to return to their place of origin (Article 7(1)(b) of Annex VII to the Staff Regulations), a removal allowance (Article 9 of Annex VII to the Staff Regulations) and a resettlement allowance (Article 6 of Annex VII to the Staff Regulations). It should be noted that if these allowances are granted at the time of leave in the interests of the service, they cannot be claimed again when the official receives the Community pension.

Officials granted leave in the interests of the institution must request authorisation from the Appointing Authority if they wish to engage in outside activities, on the basis of Article 12a of the Staff Regulations and the Commission Decision on outside activities. The total of the allowance for leave in the interests of the service and the additional remuneration for external activities may not exceed 100% of the last remuneration of the official in active employment.

In addition, beneficiaries of this leave are subject to the same obligations as active civil servants (Title II of the Staff Regulations, and more specifically articles 12 ter, 17, 17 bis and 19).

In this context, in 2016, the Commission launched 16 cases of leave in the interests of the service, after consulting the DGs. It should be noted that it could have used 28 of them (5% of the number of colleagues on pension the previous year).

According to our information, most of the colleagues concerned are prepared to take up the Commission’s offer of leave. In a few cases, however, those concerned have certain questions. In such cases, DG HR checks the person’s situation and opens a consultation with the person concerned, who may be accompanied by a colleague or a staff representative during the discussions.

The Commission has assured us that it does not intend to force the issue. Consequently, no colleague should be forced to accept an offer of leave in the interests of the institution.

In the event of a disagreement, which seems theoretical on the basis of the assurances received from the Commission, the official concerned could contest the decision to grant leave in the interests of the service by lodging a complaint under Article 90(2) and then appealing to the CFI.

U4U asks the Commission:

- to take advantage of all opportunities to take leave in the interests of the service and to go as far as the maximum quota;

- not to place any colleague on leave in the interests of the service against his or her will;

- to adopt an implementation decision clarifying the reasons and the general framework for decisions to grant leave in the interests of the service, as well as the criteria governing the selection of colleagues concerned by this measure.

Read the full document (still in the form of a text under debate) :

Facts and arguments: Preserving the pension scheme for EU staff is a priority for staff!

Article by Ludwig Schubert on the pensions system (March 2016)

VP Georgieva’s semantic shift: from “Doing more with the same” to “Doing more and better with less”!

When she took office, the VP explained to the unions the difficult context of the moment. She added that we could not have more resources but that we would try to do better, which did not mean more, with the same resources.U4U, a reformist European citizens’ union, took the VP at her word and presented her with 15 proposals, submitting them to the staff beforehand, who approved them significantly, to “do better with the same things”.The request for social dialogue on these proposals, addressed to the VP, has so far gone unanswered, which is a pity. This also bears witness to a tendency within our institution to consider that staff have nothing to say, nothing to propose, and that the top-down approach is the only possible and effective one. The College is turning its back on good management practices, even when they cost nothing and have produced excellent results in the past. For example, the first of our proposals concerned the management of change and restructuring, with the involvement of staff. Current practice is brutal, top-down and often incoherent. Does the Commission, by its current silence on our proposals, want to give credence to the idea that it does not want to change its practice, preferring to leave staff to their own problems? The political expression of this refusal to engage in dialogue within the departments and with the unions can be found in this semantic shift, which is far from neutral: “Do more and better with less”. It therefore took less than two years for the Commission to abandon its ambition to intelligently manage the shortage of resources caused by the 2014 reform of the Staff Regulations and the financial framework, in favour of a restrictive policy that endangers the institution and the fulfilment of its missions. The reduction in the number of posts, accelerated by the non-renewal of 550 posts in 2016, going well beyond what was requested in 2014, is weakening services and threatening the success of missions. It is harming colleagues in their day-to-day work, while jeopardising their future. The Commission’s refusal to support the European Parliament’s initial request for an upward mid-term review of the financial perspectives is evidence of this semantic shift. Yet this revision is necessary to enable the Union to fulfil its traditional missions, to make a success of the Juncker plan, and above all to respond to the new missions resulting from the current crises and on which the EU will be judged by its citizens. President Juncker had correctly estimated the ambitions of his Commission, so that it would be one of a last chance firmly seized. This new direction is likely to make things worse, with the end result of “doing less and doing it less well, with less”!U4U had understood the initial objective of doing better with the same things, but its proposals were not listened to. It expresses its disagreement with a policy of the lowest common denominator, which can only exacerbate the crisis of European integration.

18/12/2016

Pension contributions: the October 2014 compromise

1- Background to the annual adjustment of the pension contribution rate for EU staff

In December 2013, the pension contribution rates for 2012 and 2013 were adjusted by a Council Regulation (10.6% for 2012 and 10.3% for 2013), whereas they had been fixed at 11.6% since 1 July 2010.

Despite this late agreement on 2012 and 2013, the annual adjustment of the pension contribution rate for 2011 remained pending. Because of the Commission’s appeal to the European Court of Justice (case C-453/12), the Council had refused to adopt the rate for 2011.

Following the settlement on the 2011 salary adjustment (0.8% increase for 2011 and 2012), the Commission undertook to make a proposal to revalue the 2013 pension contribution rate accordingly.

The rate for 2011 had yet to be settled. The Commission’s proposal of 16 July 2014 to set the pension contribution rate for the years 2011, 2012 and 2013 was as follows:

- 2011 (July 2011-June 2012): reduction from 11.6% to 11.0

- 2012 (July 2012-June 2013): reduction from 10.6% to 10%.

- 2013 (July 2013-June 2014): increase from 10.3% to 10.6%.

and thus aimed to find a definitive solution for the pension contribution rate for 2011 and its effects for 2012 and 2013;

2- The compromise between the Council and the Commission, adopted on 21 October 2014 by the Council’s Working Party on Staff Regulations

Discussions between the Commission and the Council’s Staff Regulations Group finally validated the Commission’s calculations for 2011 and revised the rate for 2012, based on the new calculation for 2011.

However, some Member States raised a problem relating to the legal basis concerning the moving average which applies to certain parameters (real interest rate, rate of change in remuneration), used to calculate the contribution rate, whereas the Pension Method in Annex XII no longer applied in 2013. The Member States proposed continuing to apply the average of 12 years, whereas the Commission proposed a period of 16 years. The Staff Regulations Group recommended the solution most unfavourable to staff (contribution rate set at 10.9%), while the Commission defended an approach consistent with the new Staff Regulations (contribution rate set at 10.6%).

In the interests of appeasement, the Commission has accepted a compromise which allows the pension contribution rates for 2011, 2012 and 2013 to be definitively validated and the updating procedure for 2014 to be launched, which does not require a Council regulation to set the pension contribution rate. In addition, the appeal pending before the Court of Justice has been withdrawn.

The changes are as follows:

- 2011 rate: from 11.6% to 11.0%: +0.6% from 01.07.2011 to 30.06.2012. Positive recovery: 12 x 0.6% = +7.2% of a gross monthly salary;

- 2012 rate: from 10.6% to 10.0%: +0.6% from 01.07.2012 to 30.06.2013. Positive recovery: 12 x 0.6% = +7.2% of gross monthly salary;

- 2013 rate: from 10.3% to 10.9%: -0.6% from 01.07.2013 to 30.06.2014. Negative recovery 12 x 0.6% = -7.2% of gross monthly salary;

- 2014 rate: set at 10.1% from 1 July 2014. Positive recovery of -0.2% x 6 = +1.2% of a gross salary, then +0.2% over the 6 months of 2015, idem.

If we add up all these changes, all civil servants and agents recruited before 1 July 2011 should recover 8.4% of a gross monthly salary. Community tax must be deducted from this sum. Colleagues, recruited between 1 July 2011 and now will have a clawback calculated according to their date of entry.

31/10/2014

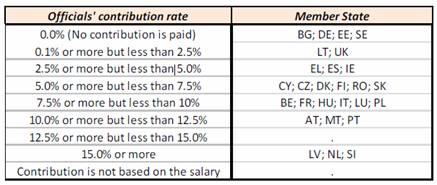

For the record, here is a table comparing the situation of central civil servants in member countries:

Adjustment of the rate of contribution to the EU staff pension scheme: an update on the issue

1- Background to the annual adjustment of the pension contribution rate for EU staff

In February 2014, the Commission succeeded in getting the Member States to adopt the pension contribution rate for 2012 and 2013, which had been 11.6% since 1 July 2010.

The pension contribution rate has therefore been set as follows:

- For 2012 (July 2012-June 2013), the decision was: 10.6% instead of 11.6

- For 2013 (July 2013-June 2014), the decision was: 10.3% instead of 11.6%.

However, the annual adjustment of the pension contribution rate for 2011 was the subject of an action before the European Court of Justice (case C-453/12). At the Commission’s request, the Court suspended this case to give the parties the opportunity to agree on a global solution to all the problems linked to the rate of contribution to the pension scheme. For 2011, it remains set at 11.6% of gross salary, and does not take into account the Commission’s proposal to set it at 11.0%.

2- The Commission’s proposal to close the file on the rate of contribution to the pension scheme for 2011, 2012 and 2013 (COM (2014) 462)

Before the end of July, the College should adopt a proposal to settle the setting of the 2011, 2012 and 2013 pension contribution rates.

The 2013 actuarial valuation of the pension scheme constitutes a five-year valuation: the Commission is therefore required to carry out a full valuation of the scheme for this reference period, in order to ensure that the contribution rate applied preserves the actuarial balance of the pension scheme. This five-year assessment involves setting the rate of contribution to the pension scheme for 2011, which has not yet been definitively adopted by the Council, and readjusting the rate of contribution to the pension scheme for 2012.

In addition, as part of the five-year assessment, account must also be taken of Regulations No 422/2014 and No 423/2014 of 16 April 2014, which adjust, with effect from 1 July 2011 and 1 July 2012 respectively, the remuneration and pensions of EU staff, in application of Ruling C-63/12 (adjustment of 0% for 2011 and 0.8% for 2012). These changes have an impact on the pension contribution for 2013, which has been set at 10.3%.

In order to maintain the actuarial balance of the EU staff pension scheme on the basis of the contribution rate assessments made by Eurostat for 2011, 2012 and 2013, the College should adopt the following proposal concerning the pension contribution rate for the years 2011, 2012 and 2013:

- 2011 (July 2011-June 2012): reduction from 11.6% to 11.0

- 2012 (July 2012-June 2013): reduction from 10.6% to 10%.

- 2013 (July 2013-June 2014): increase from 10.3% to 10.6%.

In total, this would mean a change in contribution (increase or reduction in net salary) with arrears of :

- + 0.6% from 07.2011 to 06.2012. Recovery: 12 x 0.6% = 7.2% of gross salary

- + 0.6% from 07.2012 to 06.2013. Recovery: 12 x 0.6% = 7.2% of gross salary

- 0.3% from 07.2013 to 06.2014. Negative recovery: 12 x (-0.3% )= -3.6% of gross salary

Estimated overall recovery over the three years (2011, 2012 and 2013): 7.2 + 7.2 -3.6 = 10.8% of a gross monthly salary, from which tax must be deducted (marginal tax rate: around 45%).

We must remain very cautious, as this proposal still has to be accepted by the Council. The advantage of this text is that it definitively closes the case pending before the Court, while respecting the provisions of the Staff Regulations.

It seems that the Commission wants to close this issue very quickly, so as to launch the procedure for adopting the pension contribution rate for 2014, starting in October.

3- Setting the rate of contribution to the EU staff pension scheme for 2014

The pension contribution rate for 2014 will be set by means of the discounting procedure, which will be applied to salaries as from 2015.

This discounting procedure is as follows:

Communication by Eurostat ► evaluation by DG HR ► verification by DG BUDG ► report to the Council and EP ► meeting of the RWG ► info to the PMO ► info to the other Institutions ► publication within 15 days in the OJ.

The Member States are no longer involved in setting the pension contribution rate or adjusting salaries, which is one of the achievements of the revision of the Staff Regulations, which came into force on 1 January 2014.

According to initial information gathered by U4U, the pension contribution rate is set to fall significantly in 2014.

The Commission intends to adopt the new rate for 2014 on 15 December this year, with a likely recovery in early 2015, since the new pension contribution rate takes effect on 1 July 2014.

U4U will keep you informed of further developments. (note written on 9 July 2014)

More info on intranet: You will find the text reference in the SG Vista directory.

2010 pensions file

- 2010 Eurostat pension study,

- Council reaction to this study,

- 2012 Commission report on our pension scheme

- Extracts from AIACE’s VOX magazine, with an article by L. Schubert, written in 2010, on our pension scheme and sent to President Barroso.